A management offsite took me to Telfs, Austria and to the InterAlpen Tyrol hotel. I would get the opportunity to spend two days in quiet and picturesque luxury in this alpine resort located high in the mountains of Austria.

Review: The InterAlpen – Hotel Tyrol, Telfs, Austria

“An Old World Alpine Lodge that Allows for Peace and Tranquility with World Class Views”

The InterAlpen – Hotel is a luxury premium 5-star superior hotel in the middle of the Tyrolean Alps and a member of “The Leading Hotels of the World”. It’s located at 1,300 meters elevation amid a bank of mountains and surrounds it visitors with a Tyrolean Alpine feel.

Booking the InterAlpen – Hotel Tyrol:

My employer hosted an off site event for us at this particular property as a manner to get many of the executives together. The property couldn’t have been in a more spectacular location.

My stay at the InterAlpen Tyrol was booked through the hotel event planner. As a premium luxury property, room rates were publicly available starting at 698€ ($715 USD) per night for a a Premium Double Room on a Half Board basis.

In terms of reward opportunities, the “Leading Hotels of the World” is part of the “Leaders” reward loyalty program. The Leaders Rewards program isn’t super exciting offering a few select pre-arrival upgrades, complimentary wi-fi and continental breakfast for two.

Despite being an upscale independent property, surprisingly the property is not part of the American Express Fine Hotels and Resorts.

Getting to the InterAlpen – Hotel Tyrol:

I arrived to the InterAlpen – Hotel Tyrol by car, having driven from Munich, Germany earlier in the morning.

The hotel is located at 1,300 meters in the mountains of Austria. The hotel has a resort location well into the mountains, so it’s not easily within walking distance of many other features.

The road itself was a little twisty on the way up from Innsbruck, but not impossibly so.

Arriving to the hotel, the arrival garage is very impressive for a hotel, and was among one of the most luxurious garage features I’ve ever had the opportunity to experience.

The parking garage area also featured bike and ski lockers, which was a convenient place to store equipment. The ski valet area was closed for the season, as a result of my July visit.

As with most of the themes of the Inter – Alpen Hotel, the public areas of the hotel were tremendously opulent and luxurious.

Checking into the Inter Alpen Hotel Tyrol:

I proceeded up to the lobby level of the Inter Alpen Hotel for the check in process.

The lobby is a grand and opulent space that was beautiful by every stretch of the imagination. The lobby was styled similar to a mountain manor or luxurious chalet. A series of double staircases wrapped their way around the double level space.

The windows off the lobby fronted the alpine view of neighbouring mountains, making the lobby area a transition space for heading outside.

The upper floors of the lobby contained event and conference space. The area was widely spaced and had enough capacity for people to gather between sessions. The hotel was well set up for an event hotel and was fully self sufficient for a gathering of our group size which was approximately 150 participants.

Getting back to the check in process, on our arrival at 11 AM, not unexpectedly, our rooms were not available until the check in time of 3 PM. We were invited to visit the lobby for tea.

I ended up enjoying a short coffee while we waited for our room assignments and our colleagues to arrive.

The Room: A Deluxe Double Room

68 m² – Bedroom with a double bed mostly with second bedroom with one bed, dressing room, living area with tiled stove, bathroom with bathtub and separate shower.

While I was having coffee in the lobby, the reception brought over a whole handful of keys and distributed them. As I was checking in as part of an event, I wasn’t expecting and special treatment given that they were processing about 150 people within our group.

I wandered my way up to Room #224, which was physically on the third floor. The hotel, like all others in Europe, count the first floor about the ground floor as the first floor.

I let myself into the room. The decor of the room was very old world and designed in an Alpine Ski Lodge feel with matching decoration to match. The ambience felt older and old fashioned.

Immediately upon entering the room, you found yourself in a thin hallway. The hallway contained a bathroom on the left, and a dressing / compact sleeping area on the right. The hallway led into the main part of the room.

I was assigned a deluxe double room, which contained two doubles. The beds were spacious for a single business traveller. However, it would have been a little compact for two travellers sharing a double bed.

The beds themselves were comfortable. The beds offered the thicker European duvets that don’t wrinkle. The rooms at the hotel property were also quiet and absent of any background noise as a result of it’s wonderful location set in the alpine mountains.

The room led into a living room area, that was closest to the windows. The living room featured a couch, an occasional chair, a table and chairs, and a drawing desk with integrated flat screen television.

The couch itself was quite green. It was quite faded and older looking; certainly not the type of couch that I saw myself jumping into. As a result, I didn’t spend any time sitting there.

The balance of the living space featured a make up table and chair, along with a dinig area that was half booth, half chairs.

The dining area of the room had a fun European cow themed light, complete with alpine cow bell.

The room television was off set from the bedroom area. It was located above a small writing table.

The living area of the room was well equipped as a 5 star hotel should be. It featured a variety of glassware, along with a fully stocked mini bar that contained champagne, white wine and some soft drinks. There were no spirits located within the mini bar. However, there was certainly enough there to get you started.

Towards the front of the room, there were able storage areas for outdoor clothing. These storage spaces were integrated into the wall. It also contained the hotel’s in room safe.

Opposite the bathroom, there was also a small dressing area that could double for a child’s sleeping area.

The bathroom was large and spacious. It was well equipped with a bathtub and a stand up shower. In European style, the bathroom also featured a bidet.

The hotel room also featured white cloth terry ropes, something that I always appreciate while staying as female traveller.

The hotel is shaped in a hexagonal six sided shape. Most of the rooms at the property have great views. The room also offered room service and everything that could be expected from a five star hotel.

Room with a View:

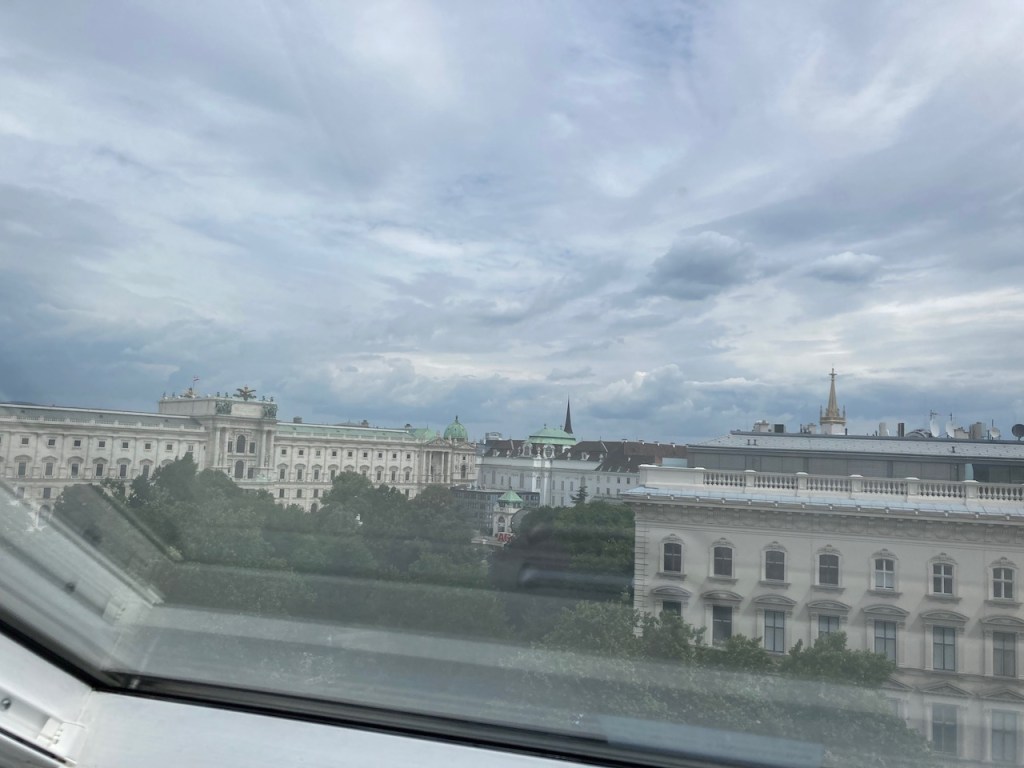

The best part of the hotel room was the view from my deluxe double room. It looked out over the mountain range. There was a variety of weather systems passing through the adjacent mountain ranges which led to a variety of views throughout my two day stay.

The balcony featured a small sitting area for two. This allowed a view over the lower level hotel gardens.

The views ranged from completely cloudy and obscured to distant and welcoming.

Overall, the room itself was a little bit of a dated space consistent with the alpine resort feel of it. The best feature of the hotel room was the view of the surrounding mountains.

Around the Resort Property:

Outdoor Hotel Grounds:

Being set in the mountains, the Inter-Alpen Hotel Tyrol had some spectacular hotel grounds. Off the ground floor and lobby area, the hotel had expansive viewing opportunities of the local mountain ranges.

It was really impressive to see the changes in alpine weather, and impressive to see the different types of views that you have between each weather system.

Outdoor Pool:

On a lower level, the hotel offered an outdoor pool and lawn area. The pool made for a beautiful setting for a swim. Despite visiting in July, I didn’t find the area to be all to warm. As a result, I would consider the outdoor space to be an “alpine” swim.

Food and Beverage:

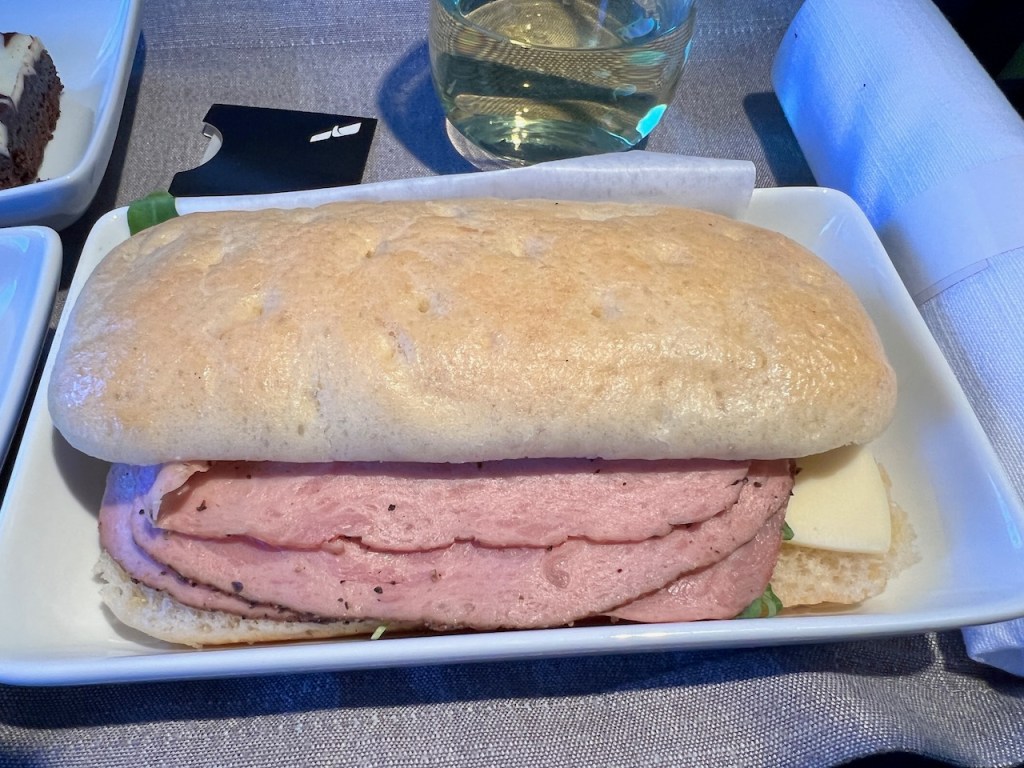

Inter-Alpen Restaurant:

During our stay, which was part of an event, we had organized dinner prepared by the hotel. While we didn’t eat in the hotel’s Inter-Alpen Restaurant, the food was tasty and well prepared.

The Bottom Line: The Inter – Alpen Hotel Tyrol

The Inter – Alpen Hotel Tyrol was a traditional and classy hotel nestled in the alps. It was very peaceful and quiet with nothing around to distract you from relaxing. I found the rooms to be a bit on the dated side, while the views outside your window were world class.

If you have visited the Austrian Alps, is there a particular resort that brings you back?

On a recent weekend stayover after a week work of business meetings, I ended up at the Le Meridien Vienna hotel for a personal stopover in Vienna, Austria. I was really impressed with the Le Meridien Vienna. It offered the right combination of value, friendly service, a comfortable and spacious room by European standards and easy walkability around town.

Review: Le Méridien Vienna – Wien Hotel, Austria.

“The Le Meridien Vienna met all the right marks for a personal stopover in Vienna: a decent room rate, friendly service, a spacious room and a terrific elite breakfast”

On an extension of a business trip in Germany, my travels took me to Austria. While in meetings at Telfs, Austria, I decided to stay over a few additional days in Vienna Austria on my first visit to the city.

Booking the Le Meridien Vienna:

When it came time to checking out hotels in Vienna, Austria, I was looking for something that was conveniently located in the central business district and close to downtown. The hotel had to have easy train access as I was arriving to the inner city by train.

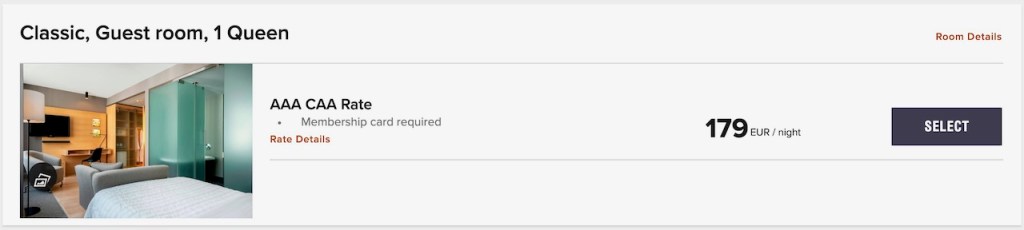

I ended up settling on the Le Meridien Vienna as a result of its location next to the train network. I had a late arrival close to midnight and the station was within five minutes walk. The price point at 157€ ($160 USD) per night on a four night stay was also quite reasonable for an inner city hotel. The price later rose to 179€, but I have seen rates as high as 300€ at the property.

The hotel participates in the Marriott Bonvoy reward program. Under the new variable pricing method, rooms are available for approximately 55,000 to 57,000 Marriott Bonvoy points per night. If you value Marriott Bonvoy points at 0.005 cents a point, you would have to have a hotel rate of 280€ / $285 USD in order to come out ahead redeeming points.

As a Marriott Bonvoy Titanium level member, I would also be entitled to the best available room, including select suites, and a welcome amenity including breakfast, additional Marriott Bonvoy points or a local welcome gift.

The hotel has a number of Suites in the Marriott Suite Night Award program. As I had some expiring Suite Night Awards that had been extended as a result of the pandemic, I applied them to all available rooms. I would end up getting upgraded into an Executive Guest Room – 1 King.

It’s always a great feeling getting a great value out of any loyalty program and this was a good use of Marriott Bonvoy Suite Night Awards that would have otherwise gone to waste.

Getting to the Le Meridien Vienna:

Starting the day in Telfs, Austria, I left my conference from the hotel at about 4 PM.

I arrived into Vienna on Obb Railjet to the arrived the Wien Hautbahnoff. I transferred to the local Red “D” Train from Wien Hautbahnoff to the nearby Oper, Karlsplatz U station. From there, it was approximately a five minute walk on level streets that was in a mix of quiet residential and business area. I didn’t have any challenges walking this distance carrying a rolling suitcase and my laptops.

The Le Meridien Vienna was situated in a residential apartment neighbourhood with some restaurants at ground level. I found the neighbourhood to be safe and clean; even arriving at midnight. I didn’t get harassed walking into the neighbourhood, even arriving after midnight.

Checking into the Le Meriden Vienna:

I walked into the Le Meridien Vienna. As I was arriving just past 12:30 AM, there was no wait at check in. Check in was exceptionally friendly. I accepted breakfast coupons for breakfast in the hotel restaurant as the Marriott Bonvoy Titanium welcome benefit.

I inquired about food and beverage but learned that all the hotel restaurants were just in the process of closing for the night. I asked if it was possible, despite the late arrival to get a glass of white wine. The front desk finished up the check in process and ran over to the bar to produce a large glass of white wine that I could take up to the room. It was an exceptionally pleasant welcome and more than I would have expected from my usual North American hotels.

Lastly, in order to accomodate a late evening departure, I also asked for a 4 PM Titanium Late Check, courtesy of Marriott Bonvoy Titanium Status. This was provided on the day of departure without any challenges.

In terms of service, the hotel was exceptionally accommodating with requests. They were very pleasant in order to deal with at each and every opportunity.

The Room: An Executive Guest Room

1 King

I was assigned room #801, an executive guest room with one king. The room was located close to the elevator. Despite the proximity to the elevator, I wasn’t bothered by elevator noise throughout the stay.

Immediately upon entering the room, there was an armoire suited for hanging clothes and jackets. There was a small foyer area that was perfect for room arrivals; an area to take off your jacket and hang it up.

The in room safe was also found in this area, in addition to luggage racks.

Ever important for any female traveller are the existence of robes and slippers. I’m happy to report that the Le Meridien Vienna had both of these. They were dispensed from the front armoire closet by the front door.

Immediately to my left on the entrance was the rather industrial entrance to an bathroom. The ensuite bathroom was situated just across from the entrance. Initially, I thought that this was a closet, but it turned out to be an ensuite bathroom.

The main part of the room then led into the bedroom area that was up against a sloping roof. A workspace was found immediately on the right hand side of the room, followed by a two person occasional chair seating space.

Working my way into the room, there was a sloping ceiling with skylight windows. This slope led to the king size bedroom area.

There was a small television just off the bedroom, that allowed you to watch from bed at an angle.

The primary bathroom was located behind the sleeping area. The bathroom itself was absolutely massive with space to run around in. Given that normal bathrooms in Europe are exceptionally tiny, it was a treat to have such a large space.

The bathroom featured a large shower with multiple jets, including a rain shower. There was also a single stand alone tub that was suitable for bathing.

As is the case with all Le Meridien hotels, the toiletries were Malin and Goetz branded hand wash and body wash.

The hotel also offered a welcome amenity of some fresh fruit, which was served in an upright glass.

The room also featured a small coffee maker, along with proper glassware. Proper glassware is something that is always appreciated whenever traveling through hotels.

The hotel only featured fourteen rooms per floor. The Executive Room was one of the few that was on the corner next to the bank of three elevators.

The Executive Room offered a view that overlooked the roof tops. The sky light windows made the rooms bright.

Around the Hotel Property:

Indoor Pool:

Surprisingly for an inner city property in Europe, the Le Meridien Vienna offered a small indoor pool. Like most others, the pool was located in the basement.

The gym at the hotel was full of people each time I visited. As a result, I did not get a photograph of this space.

Sundries Store:

The hotel featured a small sundries area off the lobby that offered items for purchase.

Food and Beverage:

Sala Terrena for Breakfast

Marriott Bonvoy Platinum Breakfast:

I enjoyed a Marriott Bonvoy Titanium Breakfast in the “Sala Terrana for Breakfast” restaurant that was located on the ground floor located just off of reception. I can’t say I’ve ever been to a restaurant that has “breakfast” right in the name, but it certainly did the trick. As with the name, the “Sala Terrana for Breakfast” was only open during breakfast hours.

The breakfast space was bright and inviting. I was always able to get a place to sit without any issue.

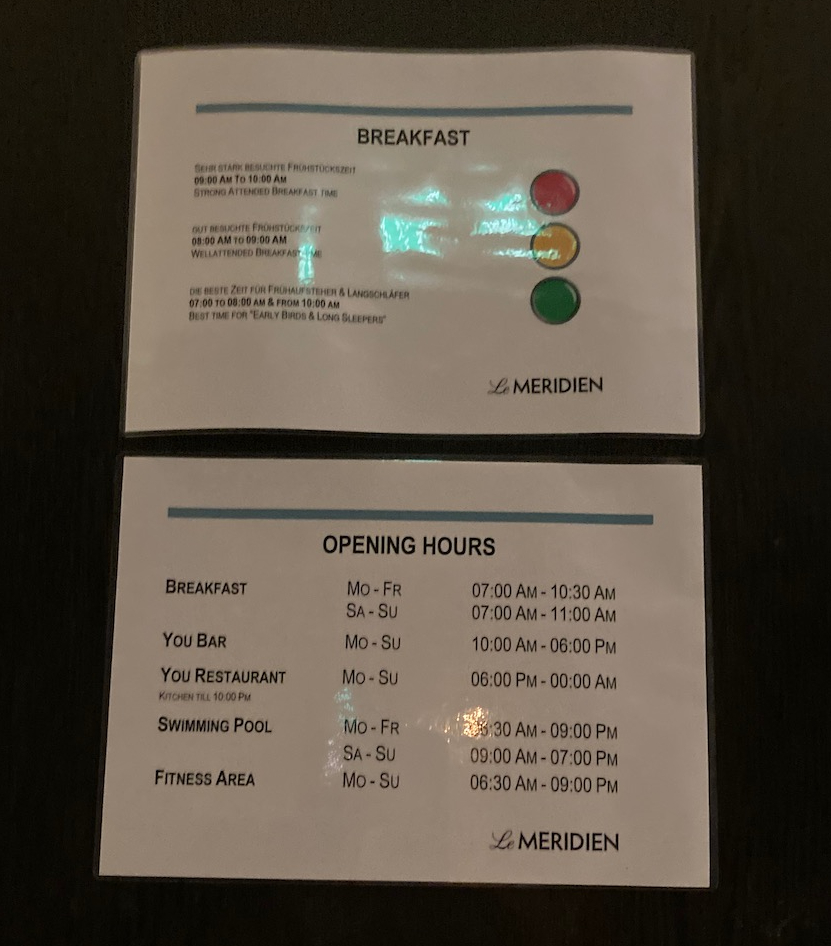

Surprisingly, the Le Meridien Vienna featured a posting of when the busy hours of breakfast were anticipated to be. The hotel also offered breakfast until 10:30 AM, with service up to 11:00 AM on weekends; something that is always appreciated for time zone affected travellers like myself.

The breakfast offered for Marriott Bonvoy Platinum and higher elites were complimentary full access to the buffet. There were the usual grain and bread favourites, but there was also an egg station along with various salads, hummus and coffees and teas.

The buffet also featured the largest slab of butter I have seen at a buffet. I actually mistook it for a brick of cheese, initially.

The Buffet Featured the Largest Slab of Butter in Vienna

There was also free flow prosecco during the breakfast hour, which I was especially pleased with.

You Restaurant and Bar:

The Le Meridien Vienna also offers the You Restaurant and Bar. The You Bar was accessible from outside the property, and featured a small single lane outdoor patio that immediately faced the sidewalk.

The You Restaurant and Bar was also accessible from within the Le Meridien Vienna through a pass through of ways into the hotel.

I didn’t actually use this space as I found it rather dark and uninviting for a single female business traveller. While I suppose it could be the right spot for a date, it really wasn’t my scene for a single woman traveller.

The Bottom Line: Le Meridien Vienna

The Le Meridien Vienna hit all the right marks. The service was pleasant, the room upgrade was welcomed and the food and beverage offered at the property was reasonable. The location of the hotel was also really good, as most sights were walkable from my property. I felt like I got my value for money staying here, and I would easily return.

If you have visited Vienna, have you stayed at the Le Meridien Vienna ?

A recent business trip to Hartford Connecticut, United States on my usual business circuit had me needing a short two night stay at a business hotel in the area. I ended up at the Sheraton Hartford South Rocky Hill property, which was located just off the highway in a suburban location near the Rocky Hill business park of Connecticut, United States.

Review: Sheraton Hartford South Hotel, Rocky Hill Connecticut, United States of America.

“A Convenient Property Located next to Rocky Hill Business Park that Featured Higher on the Functionality scale than the Aspirational one”

Booking the Sheraton Hartford South:

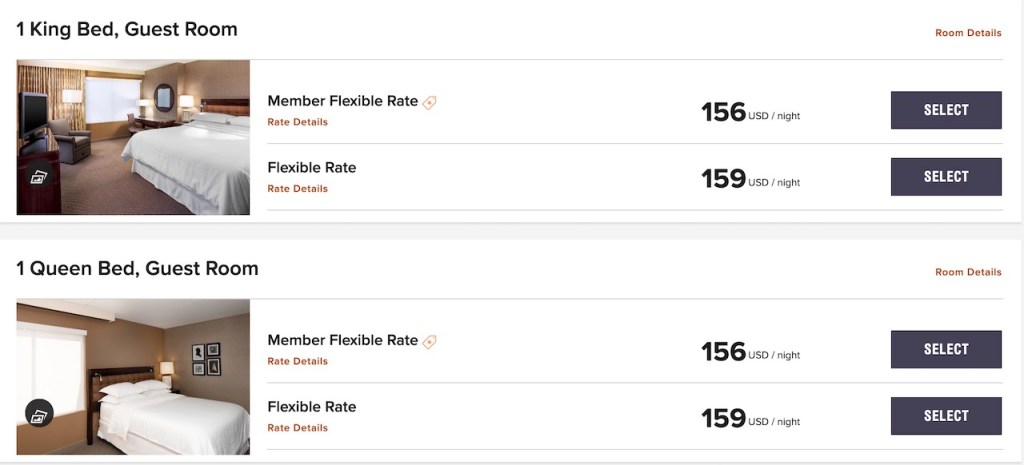

On a recent work trip to Hartford Connecticut, I needed a convenient hotel near my appointments. As a Marriott loyalist, I ended up staying at the Sheraton Hartford South Hotel. This was the only reasonable option in the area, aside from a nearby Residence Inn by Marriott Hartford that earns Marriott Bonvoy points at half the rate.

As this was a business trip, I ended up booking with a cash rate. The property seemed to average rates around $150 – $165 USD, with rates that were pretty static throughout the calendar.

The hotel offers rooms in the Marriott Bonvoy Rewards program with rooms offered for around 25,000 points per night for a basic Guest Room One King. While I can’t imagine anyone wanting to redeem Marriott Bonvoy points at this particular location, if you value Marriott Bonvoy points at 0.005 cents per point, you’d be ahead at redeeming points if your rate was above $125 USD per night.

As a Marriott Bonvoy Titanium level member, I would also be entitled to the best available room, including select suites, lounge access (when open), and a welcome amenity including breakfast, additional Marriott Bonvoy points or a local welcome gift.

Getting to the Sheraton Hartford South:

The Sheraton Hartford South is located in Rocky Hill Connecticut, United States of America. I arrived after the rental car counters were closed, and I took a taxi from the Bradley International Airport located in Connecticut, United States of America.

There wasn’t any traffic at two in the morning, and I arrived at the hotel after about 26 minutes.

The Sheraton Hartford South is located in a business park immediately off the Interstate Highway 91.There is plenty of free hotel parking outside of the hotel property so if you happen to self drive, parking is easily accessible without having to navigate a parking garage and their elevators.

The hotel is located several miles / kilometres from any off – hotel restaurants, so having a car is likely much more convenient to get around to the amenities of the area.

The Sheraton Hartford South Hotel location is a little remote and I wasn’t able to easily get a taxi back to the airport; having being quoted by the front desk a thirty minute wait for a taxi back to the airport. As a result, I ended up taking an Uber back to the airport with less than a ten minute wait. If airport travel is in your schedule, make sure you plan for extra time.

Checking into the Sheraton Hartford South:

On arrival to the property, it was nearing 2:30 AM. I was attended to promptly at the front desk. The lobby is a large area, with bright high ceilings and the usual Sheraton colours.

As a Marriott Titanium member, my status was recognized as a Titanium member. I was offered a welcome bonus of 1,000 Marriott Bonvoy Points in addition to a complimentary breakfast in the Common Restaurant with a courtesy warning the ath t Sheraton Club Lounge was presently closed.

The check in was quick. and smooth, which is just what you want at 2 AM. The lobby was spacious and mildly pleasant; much better than a tiny Fairfield Inn which is usually limited to a front counter and a tiny sofa area.

The lobby offered Sheraton Link computers with printers, which were convenient for print jobs.

While I checked in, I was offered the “best available room”, which in this case was a standard corner room on the Club Floor. There aren’t many suites or speciality rooms at this property, so by terms of scale, this was a reasonable upgrade.

When it came time to depart, I headed straight from meetings to the airport. As a result, I didn’t get an opportunity to try out a late check out offer at this property, courtesy of Marriott Bonvoy Titanium status.

The Room: A Guest Room, 2 Double

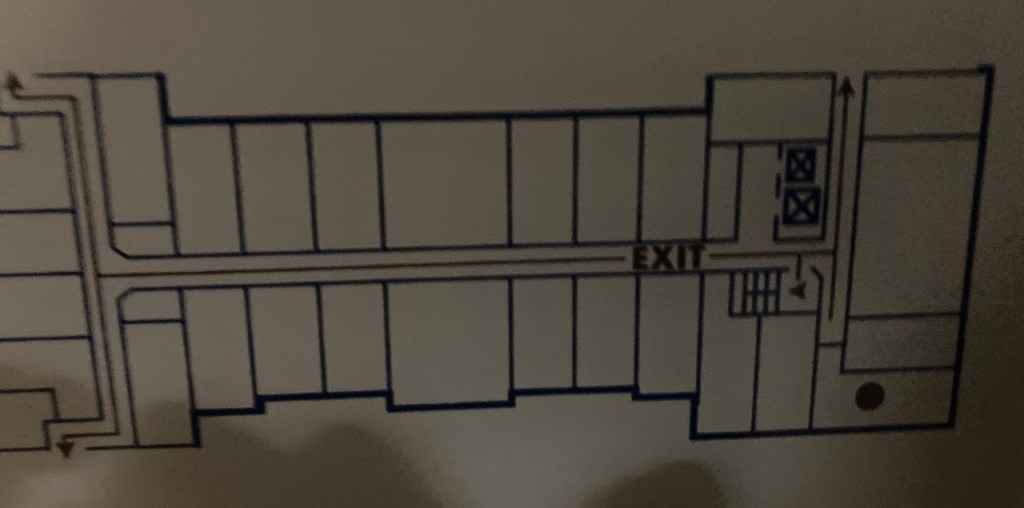

After being checked in, I found my way up to room number #429 which was on the top floor. I passed by the double elevators

Being a corner room my room had a strange “L” shaped entrance to it through a long hallway.

The room was decorated in the standard Sheraton beiges. While I didn’t book two double rooms, I didn’t mind having the extra space in order to stretch out for organizing my bags and other business stuff.

The room featured the Sheraton Sweet Sleeper Bed along with the usual Sheraton linens.

The room featured a large flat screen television, and a small work space desk.

The room featured complimentary bottled water, along with Starbucks drip coffee. The room featured plastic glasses in a Four Points by Sheraton touch. I always appreciate having bottled water, as it makes the stay just that much more comfortable.

The room was quiet and, as a result, the sleep quality was quite good. The room was away from the elevators and didn’t have a lot of hallway traffic to disturb.

The bathroom attached to the room was compact and straight forward.

The in room closets offered the usual iron and ironing board, which was handy for pressing work clothes.

The room didn’t have too many aspirational views. The views represented the green areas that surrounded the hotel.

Around the Resort Property:

Sheraton Club Executive Lounge:

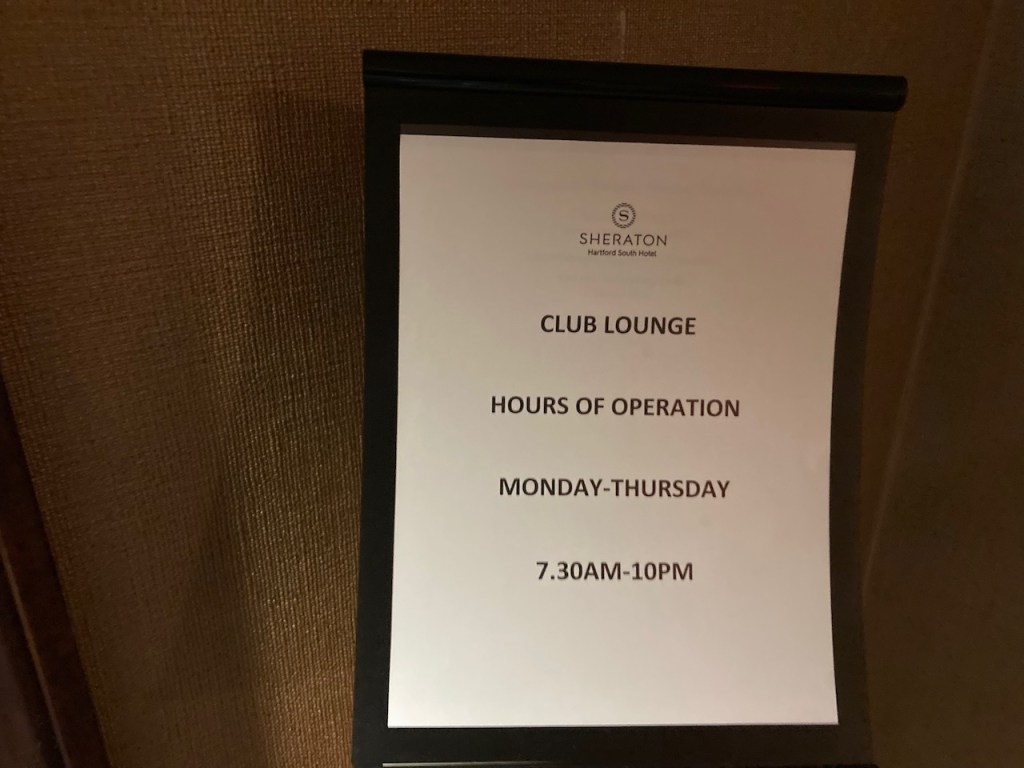

The Sheraton Hartford South offered a Sheraton Club Lounge. The lounge was closed for food service on our visit. The lounge was open but it only contained a mini fridge of small bottled waters.

The posted hours on the lounge doors were 7:30 AM to 10 PM. However, since the space wasn’t offering any food and beverage, this was more a sign of when the doors were going to be locked or unlocked.

The lounge offered some day light views, which is always appreciated in any Sheraton Club Lounge.

Sundries Store:

The property offered a Sundries Store that was located off the lobby. The store itself was pretty lean, and it was pretty basic in nature. I wouldn’t rely on the sundries store for dinner by any means, although it was handy if you were looking for a snack.

The lobby had a substantial amount of space. The lobby was often full of groups of people finalizing their business conversations for the day or otherwise completing their work projects.

The hotel offered outdoor seating in a courtyard. It was pictured a bit nicer than it actually was, as it contained many smokers. Some of the seats were also a little stained.

Indoor Pool:

The Sheraton Hartford Pool was looking a little tired with no one in it. It did offer a space, although it was empty throughout my visit.

There was also a small hot tub located off to the side. The hot tub was closed during our visit.

Food and Beverage:

Common House Restaurant:

Marriott Platinum Breakfast:

The hotel offered food and beverage on site branded as the Common House Restaurant. As a Marriott Titanium member, I was offered breakfast in the restaurant (in addition to the welcome of 1,000 Marriott Bonvoy Welcome Bonus points).

The breakfast was in the form of a breakfast buffet which featured both hot and cold items. The buffet offered a self service toast station, eggs and the usual continental items such as fresh cut fruit.

During my visit, there were two ladies who were delicately taking their time throughout the same breakfast station. I was a little pressed for time so the ladies are going to feature in the hotel breakfast photos and trip report.

Just off the restaurant, the hotel offered a bar. The bar was closed during the morning breakfast hours.

The Bottom Line: The Sheraton Hartford South

The Sheraton Hartford was more of a functional property than anywhere I’d choose to stay for leisure purposes. The property is a pretty standard Sheraton property. While everything was function and mostly clean, the Sheraton, along with others of this generation, are starting to look quite dated in appearance and comfort.

If you are a visitor to the Sheraton Hartford, does this property meet your business travel needs?

The Toronto Dominion Aeroplan Visa Infinite Credit Card is one of the more common airline credit cards in the market place today. It offers a reasonable amount of features for an airline credit card including the ability to earn 1.5 points per dollar spent on Air Canada purchases.

Credit Card Review: Toronto Dominion Aeroplan Visa Infinite Card

“The Credit Card for those that aren’t travelling everyday, that still want to earn Air Canada Aeroplan points”

The Toronto Dominion (TD) Aeroplan Visa Infinite Card is a solid airline travel credit card that features a competitive series of benefits.

TD Aeroplan Visa Infinite Card (CANADA)

Up to 50,000 Air Canada Aeroplan Miles Welcome Bonus

For our Canadian readers, this credit card is issued through Toronto Dominion (TD) Bank as the TD Aeroplan Infinite Visa Credit Card.

For our American readers, this credit card not available in the United States of America. However, it is possible to earn into Air Canada Aeroplan by getting an Air Canada Aeroplan Visa Card issued in the United States through the Chase Aeroplan Mastercard.

The TD Aeroplan Visa Infinite Card is a credit card that’s been in my wallet for many years now and is probably worth the annual fee. It offers the opportunity to earn on the largest air carrier in Canada: Air Canada and allows for redemption against the Star Alliance network.

The Basics at a Glance:

Signup bonus:

Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card

Earn 20,000 Aeroplan points when you spend $1,500 within 90 days of Account opening

Plus, earn an additional 20,000 Aeroplan points when you spend $7,500 within 12 months of Account opening

Annual fee:

$139 CAD

Earning rate:

Earn 1.5 points: for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

Earn 1 point: for every $1 spent on all other Purchases made with your Card

Earn points twice: Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore.

Earn 50% more Aeroplan points at Starbucks when you link your TD card with your Starbucks® Rewards account.

Referral bonus:

None

Perks & benefits:

- Travelling lightly through the airport and saving on baggage fees. Primary Cardholders, Additional Cardholders, and travel companions (up to eight) travelling on the same reservation will all enjoy their first checked bag free (up to 23kg/50lb) when your travel originates on an Air Canada flight.

- Enroll for NEXUS and once every 48 months get an application fee rebate (up to $100 CAD). Additional Cardholders can also take advantage of this NEXUS fee rebate.

- For a limited time, enroll to get a free Uber Pass membership for 6 months. Offer ends September 7, 2022.

- Your Aeroplan points will not expire as long as you are a TD® Aeroplan® Visa Infinite Primary Cardholder in good standing

Insurance:

Average

Card type:

Credit card

Let’s check out the detailed benefits of this particular airline credit card…

TD Aeroplan Visa Infinite Credit Card Sign Up Bonus:

The current sign up bonus for this credit card is on a carefully scripted and staggered basis. The sign up bonus offers a welcome bonus of 10,000 Air Canada Aeroplan Miles after your first purchase.

The card offers a 20,000 Air Canada Aeroplan points when you spend $1,500 CAD within the first 90 days of opening your account.

Lastly, you can earn an additional 20,000 Air Canada Aeroplan points after spending $7,500 CAD within 12 months of account opening.

This represents a total value of 50,000 Air Canada Aeroplan miles within the first year assuming you meet the requirements.

A 50,000 Air Canada Aeroplan sign up bonus is a pretty solid sign up bonus by Canadian standards; assuming you have the time, effort and energy to track your progress. It is typically higher than the usual 25,000 point / mile sign up bonuses that we have seen in the past in the Canadian market place.

TD Aeroplan Visa Infinite Annual Fee:

The TD Aeroplan Visa Infinite annual fee is $139 CAD, which places it in the upper end of an everyday airline travel card.

The annual fee is on the higher side for a premium travel card. If you are aiming for a travel airline credit card, you’re going to be paying somewhere between $125 – $150 CAD for an annual fee which makes a $139 CAD annual fee towards the top end of this range by today’s standards.

The card is in the Visa Infinite line of credit cards. This means that it is among the higher end of Visa cards.

Earn Air Canada Aeroplan points:

The TD Aeroplan Visa Infinite Card offers:

Earn 1.5 Air Canada Aeroplan points: for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

Earn 1 Air Canada Aeroplan point: for every $1 spent on all other Purchases made with your Card

Earn points twice: Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore.

Earn 50% more Aeroplan points at Starbucks when you link your TD card with your Starbucks® Rewards account.

Earning one point per dollar is a pretty typical earn rate for an airline credit card. I do find that earning 1.5 Aeroplan points per dollar on grocery and gasoline purchases is a pretty good rate of return by Canadian standards.

While I would normally recommend earning towards a transferable points currency, the reality is that (within Canada) there aren’t many that earn at a 1.5 rate right off the top. As a result, this tends to be the card that I pull first if I am at Safeway, Save – On – Foods or gassing up at Shell or Esso, within Canada.

TD Aeroplan Visa Infinite Benefits:

The TD Aeroplan Visa Infinite credit card offers a usual suite of benefits for an airline travel card.

These include the following, some of which were mentioned above:

- No Checked Bag Fees: Travelling lightly through the airport and saving on baggage fees. Primary Cardholders, Additional Cardholders, and travel companions (up to eight) travelling on the same reservation will all enjoy their first checked bag free (up to 23kg/50lb) when your travel originates on an Air Canada flight.

- Nexus Application Fee Rebate: Enroll for NEXUS and once every 48 months get an application fee rebate (up to $100 CAD). Additional Cardholders can also take advantage of this NEXUS fee rebate.

- Free Uber Pass Membership: For a limited time, enroll to get a free Uber Pass membership for 6 months. Offer ends September 7, 2022.

- No expiration of points: Your Aeroplan points will not expire as long as you are a TD® Aeroplan® Visa Infinite Primary Cardholder in good standing

While I tend to book Air Canada Flex Fare tickets (which include checked bag fees), I find I don’t get a lot of use out of the no checked bag fees. I generally try to fly “carry on only” so admittedly, I don’t find this feature to be all that useful.

The primary reason for owning this card is the ability to earn points into the Air Canada Aeroplan program. The Air Canada Aeroplan program offers access into redemptions into Star Alliance; the world’s largest airlines network.

Visa Infinite Benefits:

As an upscale credit card, the TD Aeroplan Visa Infinite Card is part of the Visa Infinite brand of cards. The Visa cards range from Visa Classic -> Visa Gold – Visa Premium -. Visa Infinite -> Visa Infinite Privilege.

The TD Aeroplan Infinite Card is towards the higher end of these cards being one level down from the top.

Visa Infinite Luxury Hotel Collection

With Visa Infinite, you can enjoy benefits like room upgrades, complimentary WiFi and breakfast, late checkout and more at over 900 Visa Infinite Luxury Hotel Collection properties around the world.

Dining and Wine Country:

Get access to exciting culinary experiences from some of the finest restaurants across Canada. Experience an evening of cooking with renowned chefs, sommeliers and/or mixologists as they guide you through each course with wine/cocktail pairings for an evening of great food and entertainment.

Complimentary Concierge:

Visa Infinite includes a Complimentary Concierge service. Your Concierge can help you with planning the perfect travel itinerary, birthday, or your next great idea. Available 24/7 at 1-888-853-4458.

While the Visa Infinite program offers opportunities similar to American Express, I find thatI don’t really use the program as much as possible. It is also marketed a lot less than the other programs with a lot less properties and opportunities on offer by comparison.

Air Canada Aeroplan Opportunities:

In terms of Air Canada Aeroplan Opportunities, the program offers access to a great number of awards. With a recent switch to a distance based model, there remain some good opportunities around the world.

One of the best redemptions for those with the flexibility to travel at the last minute (or switch travel) is Lufthansa First Class from North American to Germany and beyond.

You can redeem Air Canada Aeroplan miles for fully flat seats on All Nippon Airways in Staggered Business with world class service from North America to Asia.

Another great option is a redemption on Turkish Airlines Business Class from North American to Europe and beyond.

Back in the day, Thai Airways First Class with almost unlimited Dom Perginon, a full Thai massage, and golf cart transfers at Suvarnabhumi International Airport in Bangkok Thailand, were the award of the day.

Ultimately, I simply haven’t found another airline alliance that has as many available opportunities as Star Alliance. The TD Aeroplan Visa Infinite program offers earning into Aeroplan that allows for access into these streams.

in addition to the earning abilities into Air Canada Aeroplan, the fact that this card is a Visa Infinite card means that it is accepted almost everywhere, and there isn’t anywhere that’s going to turn you down as compared to American Express which has less merchant acceptance in my area.

Credit Card Earning Potential:

It’s possible to take a conservative look at how you can earn by using this card.

Using publicly available data from various government agencies can be used to determine both baseline income and spending averages across various categories, which we can use to compile the aggregate rewards potential for various credit cards.

Canadian Credit Card Holder Scenario:

Using Canadian data from the 2021 Census, the average income in Canada is $51,300, with a two income household at $102,600. Assuming deductions for 40% income tax, this leaves a household with $61,650 in net income.

With 40% of such expenses being charged to this credit card, $24,624 would be spent on this card, which would bring in 24,624 Air Canada Aeroplan Points annually.

If you add a $1,000 airfare after use of the Air Canada earning bonus of 1.5 points per dollar earned, you’d add another 1,500 Air Canada Aeroplan points for an annual potential return of 27,624 Air Canada Aeroplan Points.

How to Apply:

The TD Aeroplan Visa Infinite credit card is available to Canadian residents who are of the age of majority in your province/territory of residence. Your Personal annual income must be greater than $60,000, or household annual income must be $100,000 or greater.

TD Aeroplan Visa Infinite Card (CANADA)

Up to 50,000 Air Canada Aeroplan Miles Welcome Bonus

My Thoughts on the Value of the TD Aeroplan Visa Infinite Credit Card:

As a west coast Canadian resident that is situated in one of Air Canada’a hub cities, I find myself always travelling Air Canada for business reasons and occasionally for pleasure. I find reasonable value in holding this credit card; enough value to keep the card in my wallet.

The annual fee of $139 is reasonably expensive compared to its competitors in the market. The card attempts to position itself as an every day card of interest to many Canadian consumers who will likely have only one travel card in their wallet.

The category bonus for grocery and gas of 1.5 points per dollar spent means that many every day and non travelling consumers stand to earn as substantial amount of points while they enjoy life at home in their communities. This may not be the best card for every day business road warriors, who aren’t at home to purchase gas or groceries and able to earn under these categories. To be frank, when I’m on the road – which is often, I tend to put my hotel, restaurant and other travel spend on the American Express Marriott Bonvoy credit cards as the earn rates are much higher.

The Bottom Line: The TD Aeroplan Visa Infinite Credit Card

The TD Aeroplan Visa Infinite credit card is a great everyday card that is designed for the majority of customers residing in Canada.

While the category bonuses on this card for gas and grocery stores are targeted to those that actually travel less, there can be some value in maintaining this card for those that spend more time around the neighbourhood, instead of actually out on the road.

Lastly, this is the card to have within Canada if you want to keep your Air Canada Aeroplan account active. Since I go to American Express The Platinum Card for my premium travel card, the main reason I keep the TD Aeroplan Visa, is because it’s a reasonable annual fee and there are just times when you need to pay by Visa.

If you have any questions about this card, please feel free to ask them in the comments section below!

The Alaska Airlines Mileage Plan Mastercard Credit Card is one of the more useful airline credit cards in the market place today. It offers a packed amount of features for an airline credit card including the ability to earn 3 miles per dollar spent on Alaska Airlines purchases, along with the Alaska Airlines Famous Companion Fare.

Credit Card Review: Alaska Airlines Mileage Plan World Elite Mastercard (2022)

“An Excellent Everyday Credit Card and that Brings a Lot of Value if your Travel Patterns involve Travel Through the United States West Coast and Hawaii / United States”

The Alaska Airlines Mileage Plan World Elite Mastercard is a great airline travel credit card that features loads of benefits.

MBNA Alaska Mileage Plan Mastercard (CANADA)

30,000 Miles Welcome Bonus

Bank of America Alaska Mileage Plan Visa Infinite (United States)

40,000 Miles Welcome Bonus

For our Canadian readers, this credit card is issued through MBNA (owned by Toronto Dominion Banking) as the Alaska Airlines Mileage Plan World Elite Mastercard Credit Card.

For our American readers, this credit card is issued through the Bank of America with almost identical benefits under the Alaska Airlines Mileage Plan Visa Signature credit card.

It’s a credit card that’s been in my wallet for many years now and is well worth the annual fee. It offers one of the few credit cards in Canada to earn miles redeemable on the One World airline alliance and also offers the Alaska Airlines Famous Annual Companion Fare; a key selling feature of this card.

The Basics at a Glance:

Best offer is available below through a referral link

Signup bonus:

30,000 Alaska Mileage Plan miles upon spending $1,000 CAD in the first three months

Annual fee:

$99

Earning rate:

3 Alaska Mileage Plan points per dollar spent on Alaska Airlines

1 Alaska Mileage Plan points per dollar on everything else

Referral bonus:

None

Perks & benefits:

Annual Alaska Airlines Famous Companion Fare (2 for 1)

Free Checked Bag for Up to 6 Travellers on the Same Reservation

Insurance:

Average

Card type:

Credit Card

Let’s check out the detailed benefits of this particular airline credit card…

Alaska Airlines Credit Card Sign Up Bonus:

The current sign up bonus for this credit card is 30,000 Alaska Mileage Plan miles when you spend $1,000 CAD within the first 90 days of opening your account. This is higher than it has been in the past within the Canadian Market and we’ve previously seen lower sign up bonuses around 25,000 Alaska Mileage Plan miles.

A 30,000 Alaska Mileage Plan mile sign up bonus isn’t too shabby a welcome enrolment. It is easily enough for a round trip North America airline award redemption of 25,000 Alaska Miles on Alaska Airlines in Economy Class.

Alaska Airlines Annual Fee:

The Alaska Airlines Mileage Plan Mastercard’s annual fee is $99 CAD, which places it in the lower range of an airline travel card.

The Alaska Airlines Mileage Plan Visa Infinite annual fee for American readers is $75 USD, which, like the Canadian version, also positions the card in the lower range of an airline travel card.

Globally, the annual fee is on the low side for a premium travel card and offers great value in comparison to others that are currently in the market. If you are aiming for a travel airline credit card, you’re going to be paying somewhere between $125 – $150 CAD for an annual fee which makes a $99 CAD (or $75 USD) annual fee a bargain by today’s standards.

Alaska Airlines Rewards:

The Alaska Airlines Mileage Plan Mastercard offers:

Earn 3 Miles on every $1 you spend on tickets, vacation packages, and cargo services from Alaska Airlines

Earn 1 Mile per $1 on all other eligible purchases

There are no other category earning bonuses with this credit card.

Earning one point per dollar is a pretty typical earn rate for an airline credit card. While it’s always better to earn more than 1 point per dollar of spend, it’s not something that is typical unless you have specific shopping category bonuses or enter into the premium credit card market where you’re paying a much higher annual fee of several hundred dollars.

Alaska Airlines Famous Companion Fare:

Alaska Airlines Famous Companion Fare is arguably one of the best benefits going of any credit card out there.

The Alaska Airlines Famous Companion Fare allows for the purchase of any Alaska Airlines economy class fare, and allows for the purchase of a second fare on the same schedule and ticket for $99 plus taxes and fees.

The second ticket is not capacity controlled, has no black out dates and can be applied to any fare category in economy class. Unfortunately, it does not apply for Alaska Airlines First Class Tickets purchased outright. If you are an Alaska Mileage Plan Elite Member MVP, MVP Gold, MVP 75k, you can game the system by purchasing instant upgradable economy fares from Economy to First Class and get more value out of this offer.

I have to say that the Alaska Airlines Famous Companion Fare is a really terrific benefit. It really adds value when you need to travel somewhere as a couple last minute and ticket prices are expensive. There is something about knowing that you can get two $1,000 tickets for almost half price with the second economy class ticket coming in at $99 plus taxes.

I have a lot of friends and colleagues that use this companion fare to offset family vacation travel from the mainland to Hawaii. In some cases, they are able to even get a free ticket as a result of all the miles they earn every year. It’s not too far fetched to earn 12,500 miles a year, which can easily be redeemed for one leg of economy class travel to Hawaii.

The Alaska Airlines Famous Companion Fare is typically awarded a few weeks after payment of the annual fee. It does expire every year, but it is replenished after you pay for your annual fee. You only have to have purchased your ticket before the expiration date and you are allowed to fly on your ticket well after the Famous Companion Fare e-coupon expires.

Alaska Airlines Benefits:

The Alaska Airlines Mileage Plan credit card offers the usual suite of benefits for an airline travel card.

These include the following, some of which were mentioned above:

- Travel perks: get a complimentary checked bag on qualifying reservations, additional price protection on fares while earning Miles on eligible purchases toward flights and rewards

- Welcome offer:get 30,000 bonus Miles when you spend $1,000 or more on eligible purchases in the first 90 days of your account opening

- Earn 3 Miles on every $1 you spend on tickets, vacation packages, and cargo services from Alaska Airlines

- Earn 1 Mile per $1 on all other eligible purchases

- Get Alaska’s Famous Companion Fare™ every year on your account anniversary for a $99 ($121 USD incl. fees and taxes) round trip with Alaska Airlines

The card also offers a number of Mastercard World Elite Benefits, which add some value to the credit card. These benefits include:

- Mastercard® VIP Experiences: Gain access to exclusive special offers and VIP experiences based on availability

- Complimentary Checked Bag: One complimentary checked bag per passenger on the same qualifying reservation, up to a maximum of six passengers

- Price Protection: Refund the difference between the ticket you bought and a lower sale price for up to $500 CAD within 60 days of purchase

- Concierge Service: Mastercard® concierge service is available to serve you any time, day or night

Most importantly, the card offers the ability to earn points into the Alaska Airlines Mileage Plan program. The Alaska Airlines Mileage Plan offers great opportunity redemptions, including the ability to redeem against airline members of the One World Airline Alliance.

In terms of Alaska Mileage Plan opportunities, you can redeem Alaska Mileage Plan Miles for Japan Airlines Business Class travel from North America to Asia, with a free stopover in Japan for 55,000 points.

You can redeem Alaska Airlines Mileage Plan miles for Qantas First Class from North America to Australia, with a free stopover at a gateway city in Australia for 70,000 Alaska Mileage Plan points.

Ultimately, in addition to the great earning abilities into Alaska Mileage Plan, I find that the best features of this card are the ability to earn 3 miles for every dollar spent on Alaska Airlines tickets, vacation packages and cargo services and the Alaska Airlines Companion Fare. Mastercard (and Visa) are accepted almost everywhere, and there isn’t anywhere that’s going to turn you down as compared to American Express which has less merchant acceptance in my area.

Credit Card Earning Potential:

It’s possible to take a conservative look at how you can earn by using this card.

Using publicly available data from various government agencies can be used to determine both baseline income and spending averages across various categories, which we can use to compile the aggregate rewards potential for various credit cards.

Canadian Credit Card Holder Scenario:

Using Canadian data from the 2021 Census, the average income in Canada is $51,300, with a two income household at $102,600. Assuming deductions for 40% income tax, this leaves a household with $61,650 in net income.

With 40% of such expenses being charged to this credit card, $24,624 would be spent on this card, which would bring in 24,624 Alaska Mileage Plan miles annually.

If you add a $1,000 airfare after use of the Alaska Airlines Companion Fare, earning 3 points per dollar, you’d add another 3,000 Alaska Mileage Plan miles for an annual potential return of 27,624 Alaska Mileage Plan Miles.

United States Credit Card Holder Scenario:

For our friends in the United States, the 70th percentile of wage-earning households brings in $100,172 annually and has $52,820 in standard expenses. Assuming 50% of such expenses are charged to this card, total annual card spending would be $26,410.

If our sample household spent $26,410 spent on this card, which would bring in 26,410 Alaska Mileage Plan miles annually.

If you add a $1,000 airfare after use of the Alaska Airlines Companion Fare, earning 3 points per dollar, you’d add another 3,000 Alaska Mileage Plan miles for an annual potential return of 29,410 Alaska Mileage Plan Miles.

How to Apply:

Best offer is available below through a referral link

The Alaska Airlines Mileage Plan credit card is available to Canadian residents who are of the age of majority in your province/territory of residence. Your Personal annual income must be greater than $80,000, or household annual income must be $150,000 or greater.

MBNA Alaska Mileage Plan Mastercard (CANADA)

30,000 Miles Welcome Bonus

The Bank of America Alaska Airlines Mileage Plan Credit Card is available to American Residents with a qualifying FICO credit score.

Bank of America Alaska Mileage Plan Visa Infinite (United States)

40,000 Miles Welcome Bonus

My Thoughts on the Value of the Alaska Mileage Plan Credit Card:

As a west coast resident that is a stone’s throw away from Alaska Airlines’ primary hub in Seattle, United States of America, I find tremendous value in holding this credit card.

The annual fee of $99 is more than outweighed by the Alaska Airlines Famous Companion Fare, and it’s pretty easily to get outsized value by using the companion fare on a round trip from the North American Mainland to Hawaii or almost any other destination in the United States.

The icing on the cake is the ability to earn frequent flier points that can be redeemed against carriers in the One World Alliance. There aren’t many credit cards in the Canadian marketplace that offer that ability, so this card easily beats the competitor cards like the RBC British Airways Visa Infinite and the RBC Cathay Pacific Visa Infinite credit card.

The only minus for this particular card would be for people that do not have Alaska Airlines serving an airport near them. Alaska Airlines has grown and expanded on the West Coast, so it could be challenging to use these benefits if you live in a region that isn’t served by Alaska Airlines.

The Bottom Line: The Alaska Airlines Mileage Plan Mastercard Credit Card

The Alaska Airlines Milage Plan Mastercard World Elite Credit Card is a must have credit card for most airline travel credit card holders, whether you are a Canadian or American resident.

The low annual fee of $99 makes it easy to get value from the card. In addition to saving on baggage fees, the Alaska Airlines Famous Companion Fare makes it easy to get outsized value from this card. Assuming you travel with a partner, the Alaska Airlines Famous Companion Fare can easily be redeemed on a trip around North America and Hawaii allowing for the traveler to get some great value with a minimum of effort.

Lastly, there can be some terrific bargains with redemptions within the Alaska Airlines Mileage Plan. Having redeemed well over a million miles from the Alaska Airlines Mileage Plan program, is a frequent flier program that I place a lot of value in having redeemed dozens of flights.

If you have any questions about this card, please feel free to ask them in the comments section below!

The American Express Platinum Charge Card is one of the most useful premium travel cards in the market place today. It offers some standard premium charge card features that add the most value to the card, whereas the actual earning benefits from spending on the card itself are not as exciting as they could be. It also offers access into almost any independent lounge in the world, something that isn’t offered many many credit cards.

Credit Card Review: American Express Platinum Business Charge Card

“The Leading Premium Charge Card Internationally, the American Express Platinum unlocks a lot of value provided you take the time to explore and learn all its key features.”

The American Express Platinum Card and American Express Platinum Business Charge Card are the ultimate premium credit cards in the upscale travel market today. It has had several evolutions over the years but still represents one of my favourite credit cards that I keep for the outstanding suite of benefits of offers.

The Best offer is available below through a referral link.

American Express Platinum Business (CANADA)

120,000 American Express Platinum Card Welcome Bonus with $10,000 minimum spend within the first 3 months

The charge card is issued through American Express financial institution. As a result, you don’t apply for this card from your local brick and mortar bank. You’ll likely be applying for this card directly from the American Express website, or perhaps through a referral link from a current card member.

This is a charge card that’s been in my wallet for the last several years and I find it well worth annual fee. Although the annual fee is fairly steep at $495, it does represent some solid value provided you are travelling and have the time to invest in unlocking all of the various card benefits.

As a charge card, American Express expects payment of the balance in full at the end of every reporting period. There is an opportunity to “pay over time” for a certain balance of your expenses, although this isn’t a primary feature of this card as a “charge card” category and not a credit card.

The Basics at a Glance:

The Best Offer is available below through a referral link.

Signup bonus:

Earn a welcome bonus of 120,000 Membership Rewards® points

Earn a welcome bonus of 120,000 Membership Rewards® points after you charge $10,000 in net purchases to your Card in your first three months of Card Membership. That’s $1,200 in statement credit that can be reinvested in your business.

Annual fee:

$499

Secondary Cards: $199 annually for Business Platinum Cards®; $50 annually for Business Gold Cards

Earning rate:

Earn 1.25X Membership Rewards® points

On virtually every $1 in purchases charged to your Card. Plus, earn at the same rate for virtually every dollar in purchases charged to Supplementary Cards.

Flexible Payment Option

You have the option to pay a portion of your balance over time, with interest, if you want to.

Financial Flexibility

Maximize your cash flow with up to 55 interest-free days.

There is no pre-set spending limit, and your purchasing power adjusts dynamically with your Card usage and can grow over time.

Use your points to offset expenses

Membership Rewards® allows you to offset expenses by covering the cost of purchases made on your card, in full or in part, however and whenever your business needs it.

Transfer your points, at no charge, to many frequent flyer and other loyalty programs including 1:1 to Aeroplan®and Avios.

Redeem points for flight purchases on AirCanada.com.

Referral bonus:

20,000 American Express Membership Reward Points per referral, up to a maximum of 225,000 American Express Membership Rewards per Calendar year.

Perks & benefits:

Travel the Platinum way

Explore the world with rewards, premium benefits, complimentary airport lounge access, and exclusive travel offers on American Express Travel Online.

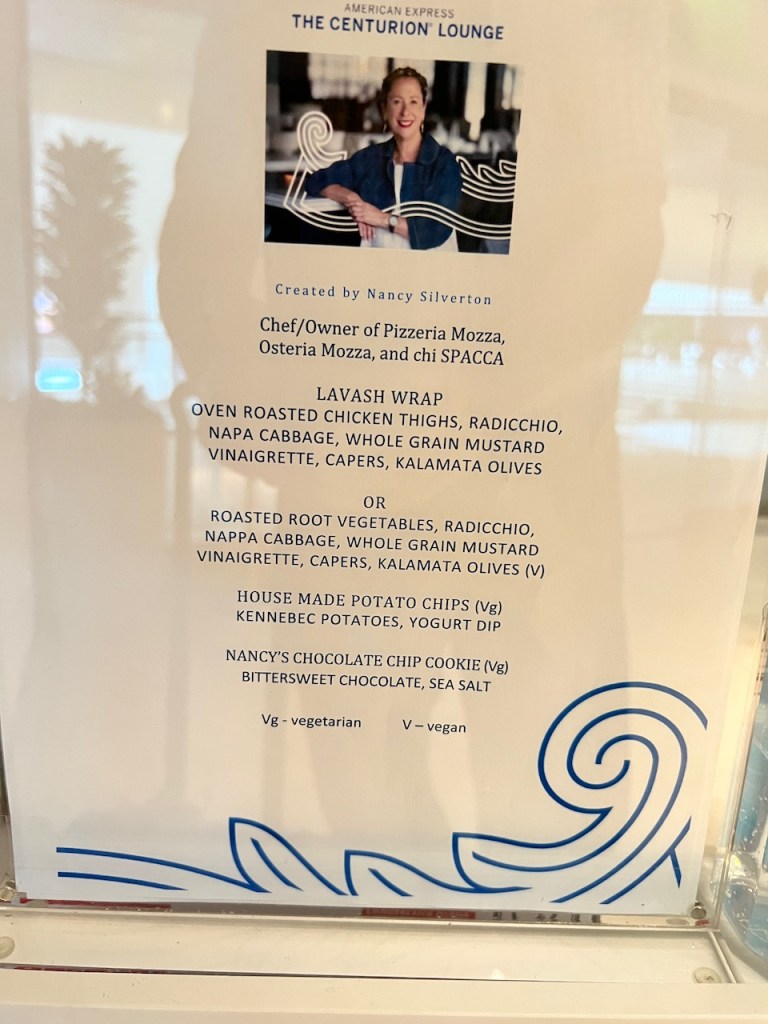

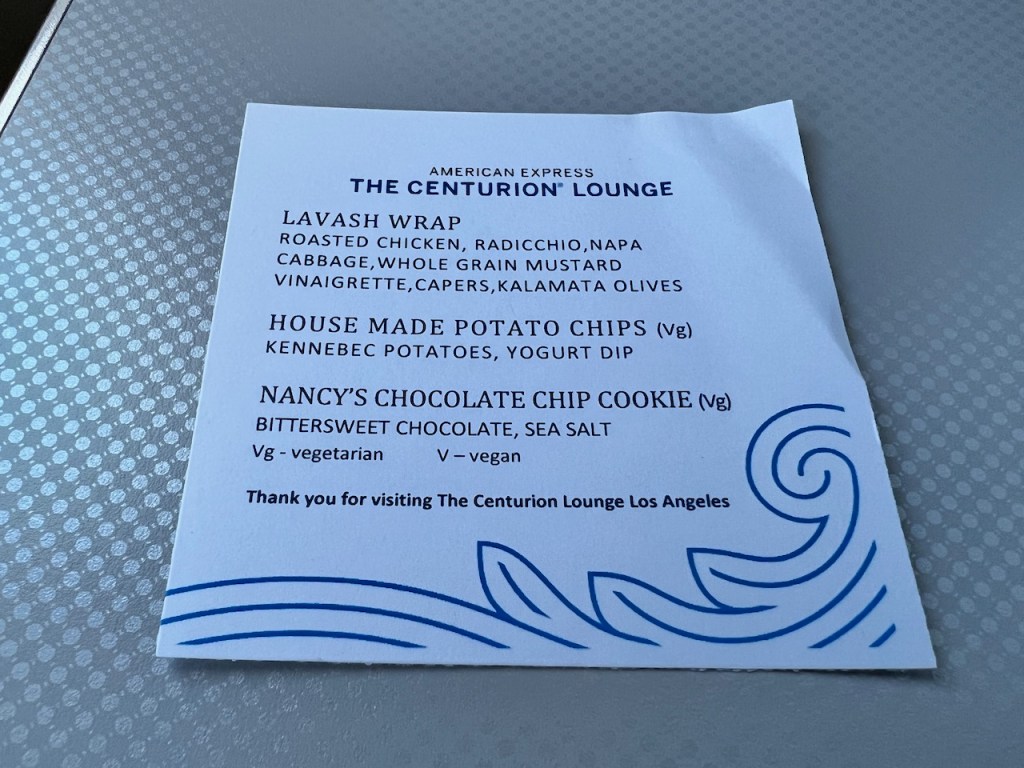

Complimentary access to over 1,300 airport lounges worldwide. The American Express® Global Lounge Collection, includes The Centurion® Lounge network, Plaza Premium Lounges, and hundreds of other domestic and international lounges designed to enhance your travel experience. Extras at over 1,000 world-class properties in the Fine Hotels & Resorts Program

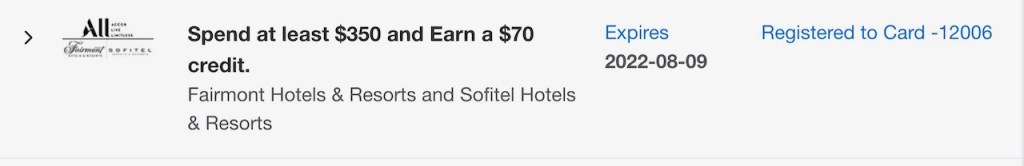

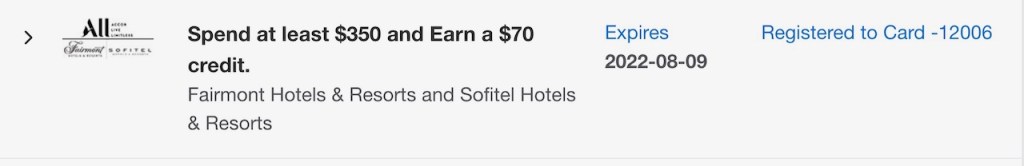

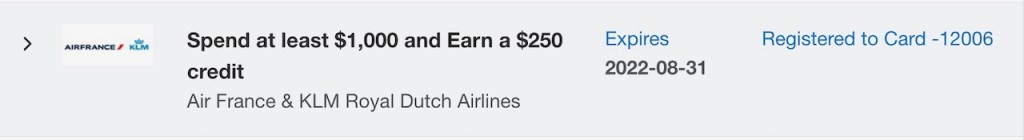

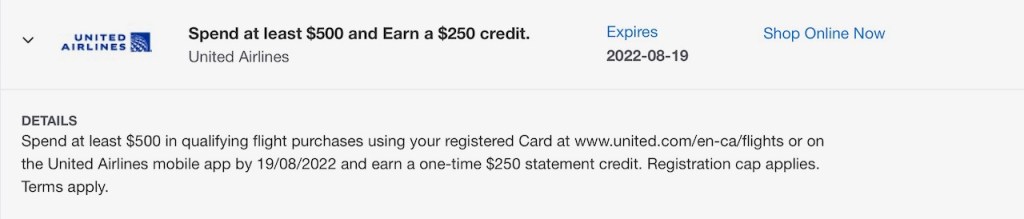

Amex offers

You can access over $1,000 in value every year with Amex Offers. Make your business purchases do more for your business with offers for dining, travel, business supplies and services, and more through the Amex App or Online Services. New offers are always being added, so be sure to check regularly.

Travel Coverage

Road trip, or flight, you could be protected when you book travel with your card.

A full suite of business solutions

From easy-to-use account management tools to help managing cash flow, it’s powerful backing that meets your business needs.

Insurance:

Above Average

Card type:

Charge card

Let’s check out the detailed benefits of this particular premium charge card…

American Express Charge Card Sign Up Bonus:

The current sign up bonus for this charge card is 120,000 American Express Membership Rewards points when you spend $10,000 CAD within the first 90 days of opening your account. This sign up bonus is much higher than it has been in the past within the Canadian market and we’ve previously seen lower sign up bonuses around 60,000 – 80,000 American Express Membership Rewards Points.

When I signed up for this card several years back, I personally got a sign up bonus of 80,000 Membership Rewards. This current offer at 120,000 Membership Rewards is substantially more generous than the sign up bonus I had access to.

Since American Express Membership Rewards convert to several frequent flier programs, including Air Canada’s Aeroplan, British Airways Executive Club Avois and Etihad Guest to name a few on a 1:1 basis, this is similar to a sign up bonus of 120,000 of your favourite airline frequent flier miles.

Admittedly, there is an attached conditional spend requirement of $10,000 within the initial three months of card membership in order to get the welcome bonus of 120,000 Membership Rewards. While this is a steep amount for some, it’s easily doable for those that have the opportunity to put some reimbursable work travel spend on their credit card. If you assume that a work trip for a week is approximately $3,000 with several days of hotel and meals, you can probably break even with just over three business trips.

American Express Annual Fee:

The American Express Platinum Business Charge Card annual fee is $499 CAD, which places it in the upper end of a premium travel card.

Globally, the annual fee is on the lower side for other American Express Platinum Charge Cards offered internationally. We’ve seen annual fees for the American Express Platinum Card range from $500 all the way up to $1,200 for some markets such as Australia. As a result, I suspect we can see an increase in this credit card’s annual fee in the not too distant future.

The card includes a suite of benefits that adds value to the card. While I kept my card throughout the pandemic when I wasn’t travelling. Admittedly, I didn’t get full value from this card when I wasn’t travelling.

American Express Membership Rewards:

The American Express Membership Rewards offers:

Earn 1.25X Membership Rewards® points on virtually every $1 in purchases charged to your Card. Plus, earn at the same rate for virtually every dollar in purchases charged to Supplementary Cards

There are no other category earning bonuses with this credit card and unlike the American Express Platinum Card personal version, all purchases are covered at the same 1.25 per $1 Membership Rewards earn rate.

This card is great to use if you need to accumulate a lot of points in a hurry, or are travelling for business. The ability to earn 1.25 points per dollar spent is pretty unprecedented in Canada and you’d have to get into the premium card markets offered by the large banks in order to compete in this area.

About American Express Membership Rewards:

The American Express Membership Rewards is the rewards program of American Express. It is a transferable points currency, that allows for redemption within American Express, or the ability to transfer to a wide range of travel, dining, entertainment and retail rewards options.

Redeeming Points

- Use points to book flights within Canada or to anywhere in the world with a fixed number of points.

- Redeem points for statement credits to offset any eligible purchase charged to your Card.

- Use points to pay for your Amazon.ca purchases at checkout.

- Use points for a wide range of gift cards and merchandise.

- Transfer points to frequent flyer and hotel programs, including one-to-one to Aeroplan® and Avios.

- Use points for flights, hotels and car rentals with American Express Travel.

- Redeem points for flight purchases on AirCanada.com.

American Express Platinum Business Charge Card Benefits:

The American Express Platinum Business Charge Card offers an excellent suite of benefits for an airline travel card.

The best feature of the American Express are the travel benefits that come along with the card. This includes a suite of travel benefits that include a comprehensive lounge access platform that includes unlimited conditional access to the American Express Centurion Lounges, in addition to preferred benefits at the American Express Fine Hotels and Resorts program.

These include the following, some of which were mentioned above:

Travel the Platinum Way:

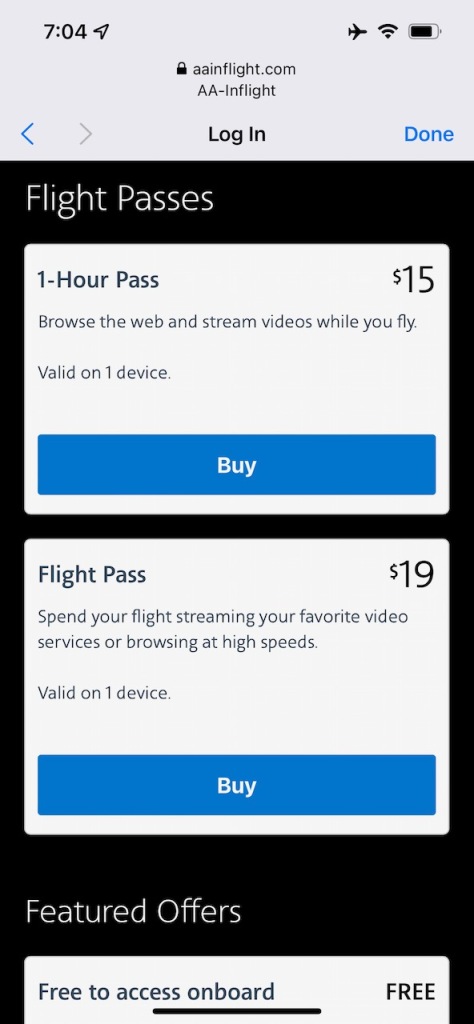

- Complimentary Access to over 1,300 Airport Lounges Worldwide. Unlimited Access to the Global Lounge Collection, including The American Express Centurion Lounge, Plaza Premium Lounges and hundreds of other domestic and international lounges designed to enhance your travel experience.

- Access to American Express Fine Hotels and Resorts: With Fine Hotels + Resorts9, Platinum Cardmembers can receive benefits such as guaranteed 4:00 p.m. late check-out, complimentary daily breakfast for two and other benefits at over 1,100 iconic properties worldwide. Available benefits have an average total value of $550 USD* based on a two-night stay.

- Amex offers You can access over $1,000† in value every year with Amex Offers. Make your business purchases do more for your business with offers for dining, travel, business supplies and services, and more through the Amex App or Online Services. New offers are always being added, so be sure to check regularly

About Complimentary Lounge Access to 1,300 Lounges Worldwide Benefit:

The lounge access benefit of of the American Express Platinum Business card offers a complimentary Priority Pass Select membership that unlocks access to hundreds of lounges around the world. The American Express Platinum Card will get you into almost any non airline alliance lounge with the presentation of a same day boarding pass.

This lounge access benefit is remarkable convenient, and you can usually find a lounge space available at an airport near you if you don’t have access to one provided by the airline.

The availability of lounge access is one of my favourite features of this particular card. It’s among the easiest of the features to access and you don’t have to be worried about flying one particular carrier over another.

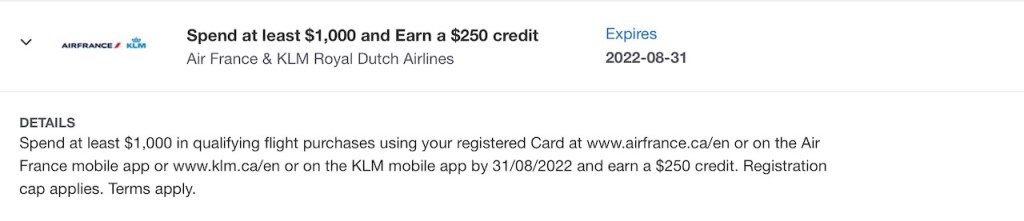

About the Amex Offers Benefit:

The Amex Offers pop into your account on an intermittent basis and offer some serious discounts

The terms and conditions for fulfilling the offer are usually listed below, in the event you want to see what items may be excluded. The American Express offers are typically valid for two to three months so with some diligent checking, you can usually plan to maximize your return on investment.

I generally get the opportunity to redeem several hundred dollars worth of offers every year. As long as you dedicate the time into checking into the offers section of the American Express website, you can usually find something good in there on a quarterly basis.

Overall, this suite of benefits offers among the largest and more comprehensive set of benefits for an elite premium travel card. The American Express Membership Rewards program offers the ability for points to be transferred to other frequent flier programs, in addition to being redeemed for other travel and even merchandise. This is a great method to stave off award devaluation, as you can move your points to a program that offers greater value.

How to Maximize American Express Membership Rewards:

In terms of American Express Membership Rewards Opportunities, we’ve made good use of the British Airways Executive Club Avios Reward program for business class flights in expensive markets at exceptionally low cost.

We have redeemed points to fly Qantas Business Class Sydney – Adelaide for 15,000 BA Avios per person, on a free ticket that is regularly $800 each.

We have also redeemed BA Avios for short haul flights crossing from Europe into Africa, when many traditional frequent flier award programs would charge a much higher category award as a result of Africa being a different continent and award zone.

We redeemed 15,000 British Airways Avios on Iberia Business Class Madrid – Marrakech and saved ourselves several tens of thousands of frequent flier points instead of using a plan like Aeroplan at the time that was charging by region and had a 30,000 premium in order to travel to Africa.

With some creative use, you can really get a lot of value for the Membership Rewards program.

Credit Card Earning Potential:

It’s possible to take a conservative look at how you can earn by using this card.

Using publicly available data from various government agencies can be used to determine both baseline income and spending averages across various categories, which we can use to compile the aggregate rewards potential for various credit cards.

Canadian Credit Card Holder Scenario:

Using Canadian data from the 2021 Census, the average income in Canada is $51,300, with a two income household at $102,600. Assuming deductions for 40% income tax, this leaves a household with $61,650 in net income.

With 40% of such expenses being charged to this credit card, $24,624 would be spent on this card earning at 1.25 per $1 spent, which would bring in 30,780 American Express Membership Rewards annually.

This is pretty much the best value card in my wallet at the moment with the ability to earn a substantial amount of points for every day spending at a much faster rate than the American Express Marriott Bonvoy personal and business credit cards.

How to Apply:

Best offer is available below through a referral link

The American Express Platinum Business Charge Card is available to Canadian residents who are of the age of majority in your province/territory of residence and have a valid credit file. There is no minimum annual income required.

American Express Platinum Business (CANADA)

120,000 American Express Platinum Card Welcome Bonus with $10,000 minimum spend within the first 3 months

My Thoughts on the Value of the American Express Platinum Business Charge Card:

The American Express Platinum Card is a card that I find delivers a lot of value.

I tend to run almost all my business expenses through this card. I also find that, when travelling, I tend to use a lot of the benefits that come with the card. These great benefits include a large lounge access network and even include discounted codes for Hertz car rental. We use the benefits so much, even MrsWT73 has an additional card as an authorized user.

As a result, this is a card that I continue to keep in my wallet.

The Bottom Line: The American Express Platinum Business Charge Card

The American Express Platinum Charge Card offers great value into a premium travel card. The American Express Global Lounge Collection offers access to it’s own collection of Centurion Lounges, in addition to a Priority Pass membership

It’s also a great feature to be able to transfer your American Express Membership Rewards points to a number of frequent flier programs.

If you have any questions about this card, please feel free to ask them in the comments section below!

The American Express Marriott Bonvoy Business Credit Card is one of the more useful hotel travel cards in the market place today. It offers some standard features that add the most value to the card, whereas the actual earning benefits are not as exciting as they could be. It also offers the ability to transfer to thirty eight different frequent flier programs, a great feature to stave off point devaluation.

Credit Card Review: American Express Marriott Bonvoy Business Credit Card

“A Leading Hotel Credit Card in North America, the value from this card is a little better than the personal version of this card thanks to better category bonuses, but has remained a little under performing on the “earning” side as a reward card to accumulate Marriott Bonvoy points”

The Marriott Bonvoy American Express used to be the ultimate hotel travel card. It started it’s stays as the Starwood Preferred Guest Credit Card by American Express. Over the past several years, it has lost it’s flagship position, but still delivers some great value that makes the card useful.

The American Express Marriott Bonvoy Business card is a slightly better version of the personal American Express Marriott Bonvoy Credit Card due to some category bonus, but overall it shares most of the same features.

The Best offer is available below through a referral link.

American Express Marriott Bonvoy (CANADA)

70,000 Marriott Bonvoy Point Welcome Bonus with $3,000 minimum spend + Earn a total of 5 points for every $1 on eligible gas, travel and dining purchases in your first six months of Card Membership; up to 10,000 points

The credit card is issued through American Express and is issued directly from American Express.

This is a credit card that’s been in my wallet for more than ten years now and is well worth the annual fee. It offers a leading hotel credit card position and allows for redemption at Marriott Bonvoy hotel properties, in addition to the useful ability to transfer it’s points to one of 38 different airline frequent flier programs.

The Basics at a Glance:

The Best offer is available below through a referral link.

Offer ends October 26, 2022.

Signup bonus:

70,000 Marriott Bonvoy points upon spending $3,000 CAD in the first three months.

Plus, earn a total of 5 points for every $1 on eligible gas, travel and dining purchases in your first six months of Card Membership up to 10,000 points.

Annual fee:

$150

Earning rate:

Earn 5 points for every $1 in eligible Card purchases at hotels participating in Marriott Bonvoy.

Earn 3 points for every $1 in Card purchases on eligible gas, dining and travel.

Earn 2 points for every $1 on all other purchases charged to the Card

Referral bonus:

15,000 Marriott Bonvoy Points points per referral, up to a maximum of 150,000 Marriott Bonvoy Points per Calendar year.

Perks & benefits:

Annual Free Night Award

Marriott Silver Bonvoy Status; upgraded to Marriott Bonvoy Gold after $30,000 annual spend

Elite Night Credits – Receive 15 Free Night Credits in the Marriott Bonvoy program

A Room Upgrade – Where Available

A Late 2 PM Check Out, Subject to Availability at Conference and Resort Hotels.

Insurance:

Average

Card type:

Charge card

Let’s check out the detailed benefits of this particular airline credit card…

Marriott Bonvoy Credit Card Sign Up Bonus:

The current sign up bonus for this credit card is 70,000 Marriott Bonvoy points when you spend $3,000 CAD within the first 90 days of opening your account. This is higher than it has been in the past within the Canadian Market and we’ve previously seen lower sign up bonuses around 60,000 Marriott Bonvoy points.

Since Marriott Bonvoy points convert to many airplane frequent flier programs at a 3:1 ratio, this is similar to a sign up bonus of 25,000 of your favourite airline frequent flier miles.

Marriott Bonvoy Annual Fee:

The American Express Marriott Bonvoy credit cards annual fee is $150 CAD, which places it in the lower range of an airline travel card.

Unlike in Canada, this base level version of The American Express Marriott Bonvoy Business credit cards isn’t offered anymore in the United States. You will need to upgrade to the more expensive and “not available in Canada” premium level Marriott Bonvoy Brilliant Card which has an annual fee of $450 USD.

Globally, the annual fee is on the average side for a hotel travel card and offers value in comparison to others that are currently in the market. If you are aiming for a business travel airline credit card, you’re going to be paying about $150 for an annual fee.

American Express Marriott Bonvoy Rewards:

The American Express Marriott Bonvoy Credit Card offers:

Earn 5 Marriott Bonvoy Points on every $1 in eligible Card purchases at hotels participating in Marriott Bonvoy.

Earn 3 points for every $1 in Card purchases on eligible gas, dining and travel.

Earn 2 Marriott Bonvoy Points on every $1 on all other eligible purchases

The category bonus of 3 points per dollar on eligible gas, dining and travel purchases brings this card back to what the Starwood Preferred Guest Card used to earn before absorbed by Marriott Bonvoy. The 3 points per dollar category bonus is among the best ways to earn with this card; assuming you are on the road for the purposes of your business. I frequently put all my airfare on this card for the purposes of this blog.

As with the American Express Marriott Bonvoy Personal Credit Card, this card is terrific to use if you happen to be travelling for business, or spend a lot of time staying at Marriott properties in your personal life. The ability to earn 5 points per dollar at Marriott Bonvoy properties is a pretty strong earn rate.

However, the regular earn rate of 2 Marriott Bonvoy points for all other purchases is pretty weak compared to other travel cards in this category. It is like earning 0.66 of an airline mile for every dollar spent on the card. Quite frankly, it’s at the bottom in class when it comes to comparable credit cards within North American markets. As a result, has become the last card that I pull when it comes to every day spending.

Marriott Bonvoy Annual Free Night Award:

The card comes with a Marriott Bonvoy Annual Free Night Award. This is the main reason I continue to keep this card.

The Marriott Bonvoy Annual Free Night Award is applied to your card between 8 – 10 months after your annual fee. It can be used on properties under 35,000 Marriott Bonvoy points per night. New this year, you are allowed to compliment this redemption by topping up to an additional 15,000 Marriott Bonvoy points from your account; to total a 50,000 Marriott Bonvoy point redemption.

I typically get outsized value by redeeming these certificates against properties where the nightly rate is above the credit card’s annual fee. This alone makes up the value of the card.

I have had terrific redemptions on this at the Sheraton Princess Kaiulani Honolulu in Hawaii, the Sheraton Kauai Resort, the Marriott Curaçao Beach Resort and even inner city urban locations like the JW Marriott Miami.

Admittedly though, I have also had to burn off the redemptions at a Fairfield Inn when no other hotels were available under this lower award category. As a result, it’s not a completely perfect and fool proof set up.