Credit Card Review: Alaska Airlines Mastercard

The Alaska Airlines Mileage Plan Mastercard Credit Card is one of the more useful airline credit cards in the market place today. It offers a packed amount of features for an airline credit card including the ability to earn 3 miles per dollar spent on Alaska Airlines purchases, along with the Alaska Airlines Famous Companion Fare.

Credit Card Review: Alaska Airlines Mileage Plan World Elite Mastercard (2022)

This card is no longer available for new applicants

“An Excellent Everyday Credit Card and that Brings a Lot of Value if your Travel Patterns involve Travel Through the United States West Coast and Hawaii / United States”

The Alaska Airlines Mileage Plan World Elite Mastercard is a great airline travel credit card that features loads of benefits.

MBNA Alaska Mileage Plan Mastercard (CANADA)

30,000 Miles Welcome Bonus

Bank of America Alaska Mileage Plan Visa Infinite (United States)

40,000 Miles Welcome Bonus

For our Canadian readers, this credit card is issued through MBNA (owned by Toronto Dominion Banking) as the Alaska Airlines Mileage Plan World Elite Mastercard Credit Card.

For our American readers, this credit card is issued through the Bank of America with almost identical benefits under the Alaska Airlines Mileage Plan Visa Signature credit card.

It’s a credit card that’s been in my wallet for many years now and is well worth the annual fee. It offers one of the few credit cards in Canada to earn miles redeemable on the One World airline alliance and also offers the Alaska Airlines Famous Annual Companion Fare; a key selling feature of this card.

The Basics at a Glance:

Best offer is available below through a referral link

Signup bonus:

30,000 Alaska Mileage Plan miles upon spending $1,000 CAD in the first three months

Annual fee:

$99

Earning rate:

3 Alaska Mileage Plan points per dollar spent on Alaska Airlines

1 Alaska Mileage Plan points per dollar on everything else

Referral bonus:

None

Perks & benefits:

Annual Alaska Airlines Famous Companion Fare (2 for 1)

Free Checked Bag for Up to 6 Travellers on the Same Reservation

Insurance:

Average

Card type:

Charge card

Let’s check out the detailed benefits of this particular airline credit card…

Alaska Airlines Credit Card Sign Up Bonus:

The current sign up bonus for this credit card is 30,000 Alaska Mileage Plan miles when you spend $1,000 CAD within the first 90 days of opening your account. This is higher than it has been in the past within the Canadian Market and we’ve previously seen lower sign up bonuses around 25,000 Alaska Mileage Plan miles.

A 30,000 Alaska Mileage Plan mile sign up bonus isn’t too shabby a welcome enrolment. It is easily enough for a round trip North America airline award redemption of 25,000 Alaska Miles on Alaska Airlines in Economy Class.

Alaska Airlines Annual Fee:

The Alaska Airlines Mileage Plan Mastercard’s annual fee is $99 CAD, which places it in the lower range of an airline travel card.

The Alaska Airlines Mileage Plan Visa Infinite annual fee for American readers is $75 USD, which, like the Canadian version, also positions the card in the lower range of an airline travel card.

Globally, the annual fee is on the low side for a premium travel card and offers great value in comparison to others that are currently in the market. If you are aiming for a travel airline credit card, you’re going to be paying somewhere between $125 – $150 CAD for an annual fee which makes a $99 CAD (or $75 USD) annual fee a bargain by today’s standards.

Alaska Airlines Rewards:

The Alaska Airlines Mileage Plan Mastercard offers:

Earn 3 Miles on every $1 you spend on tickets, vacation packages, and cargo services from Alaska Airlines

Earn 1 Mile per $1 on all other eligible purchases

There are no other category earning bonuses with this credit card.

Earning one point per dollar is a pretty typical earn rate for an airline credit card. While it’s always better to earn more than 1 point per dollar of spend, it’s not something that is typical unless you have specific shopping category bonuses or enter into the premium credit card market where you’re paying a much higher annual fee of several hundred dollars.

Alaska Airlines Famous Companion Fare:

Alaska Airlines Famous Companion Fare is arguably one of the best benefits going of any credit card out there.

The Alaska Airlines Famous Companion Fare allows for the purchase of any Alaska Airlines economy class fare, and allows for the purchase of a second fare on the same schedule and ticket for $99 plus taxes and fees.

The second ticket is not capacity controlled, has no black out dates and can be applied to any fare category in economy class. Unfortunately, it does not apply for Alaska Airlines First Class Tickets purchased outright. If you are an Alaska Mileage Plan Elite Member MVP, MVP Gold, MVP 75k, you can game the system by purchasing instant upgradable economy fares from Economy to First Class and get more value out of this offer.

I have to say that the Alaska Airlines Famous Companion Fare is a really terrific benefit. It really adds value when you need to travel somewhere as a couple last minute and ticket prices are expensive. There is something about knowing that you can get two $1,000 tickets for almost half price with the second economy class ticket coming in at $99 plus taxes.

I have a lot of friends and colleagues that use this companion fare to offset family vacation travel from the mainland to Hawaii. In some cases, they are able to even get a free ticket as a result of all the miles they earn every year. It’s not too far fetched to earn 12,500 miles a year, which can easily be redeemed for one leg of economy class travel to Hawaii.

The Alaska Airlines Famous Companion Fare is typically awarded a few weeks after payment of the annual fee. It does expire every year, but it is replenished after you pay for your annual fee. You only have to have purchased your ticket before the expiration date and you are allowed to fly on your ticket well after the Famous Companion Fare e-coupon expires.

Alaska Airlines Benefits:

The Alaska Airlines Mileage Plan credit card offers the usual suite of benefits for an airline travel card.

These include the following, some of which were mentioned above:

- Travel perks: get a complimentary checked bag on qualifying reservations, additional price protection on fares while earning Miles on eligible purchases toward flights and rewards

- Welcome offer:get 30,000 bonus Miles when you spend $1,000 or more on eligible purchases in the first 90 days of your account opening

- Earn 3 Miles on every $1 you spend on tickets, vacation packages, and cargo services from Alaska Airlines

- Earn 1 Mile per $1 on all other eligible purchases

- Get Alaska’s Famous Companion Fare™ every year on your account anniversary for a $99 ($121 USD incl. fees and taxes) round trip with Alaska Airlines

The card also offers a number of Mastercard World Elite Benefits, which add some value to the credit card. These benefits include:

- Mastercard® VIP Experiences: Gain access to exclusive special offers and VIP experiences based on availability

- Complimentary Checked Bag: One complimentary checked bag per passenger on the same qualifying reservation, up to a maximum of six passengers

- Price Protection: Refund the difference between the ticket you bought and a lower sale price for up to $500 CAD within 60 days of purchase

- Concierge Service: Mastercard® concierge service is available to serve you any time, day or night

Most importantly, the card offers the ability to earn points into the Alaska Airlines Mileage Plan program. The Alaska Airlines Mileage Plan offers great opportunity redemptions, including the ability to redeem against airline members of the One World Airline Alliance.

In terms of Alaska Mileage Plan opportunities, you can redeem Alaska Mileage Plan Miles for Japan Airlines Business Class travel from North America to Asia, with a free stopover in Japan for 55,000 points.

You can redeem Alaska Airlines Mileage Plan miles for Qantas First Class from North America to Australia, with a free stopover at a gateway city in Australia for 70,000 Alaska Mileage Plan points.

Ultimately, in addition to the great earning abilities into Alaska Mileage Plan, I find that the best features of this card are the ability to earn 3 miles for every dollar spent on Alaska Airlines tickets, vacation packages and cargo services and the Alaska Airlines Companion Fare. Mastercard (and Visa) are accepted almost everywhere, and there isn’t anywhere that’s going to turn you down as compared to American Express which has less merchant acceptance in my area.

Credit Card Earning Potential:

It’s possible to take a conservative look at how you can earn by using this card.

Using publicly available data from various government agencies can be used to determine both baseline income and spending averages across various categories, which we can use to compile the aggregate rewards potential for various credit cards.

Canadian Credit Card Holder Scenario:

Using Canadian data from the 2021 Census, the average income in Canada is $51,300, with a two income household at $102,600. Assuming deductions for 40% income tax, this leaves a household with $61,650 in net income.

With 40% of such expenses being charged to this credit card, $24,624 would be spent on this card, which would bring in 24,624 Alaska Mileage Plan miles annually.

If you add a $1,000 airfare after use of the Alaska Airlines Companion Fare, earning 3 points per dollar, you’d add another 3,000 Alaska Mileage Plan miles for an annual potential return of 27,624 Alaska Mileage Plan Miles.

United States Credit Card Holder Scenario:

For our friends in the United States, the 70th percentile of wage-earning households brings in $100,172 annually and has $52,820 in standard expenses. Assuming 50% of such expenses are charged to this card, total annual card spending would be $26,410.

If our sample household spent $26,410 spent on this card, which would bring in 26,410 Alaska Mileage Plan miles annually.

If you add a $1,000 airfare after use of the Alaska Airlines Companion Fare, earning 3 points per dollar, you’d add another 3,000 Alaska Mileage Plan miles for an annual potential return of 29,410 Alaska Mileage Plan Miles.

How to Apply:

Best offer is available below through a referral link

The Alaska Airlines Mileage Plan credit card is available to Canadian residents who are of the age of majority in your province/territory of residence. Your Personal annual income must be greater than $80,000, or household annual income must be $150,000 or greater.

MBNA Alaska Mileage Plan Mastercard (CANADA)

30,000 Miles Welcome Bonus

The Bank of America Alaska Airlines Mileage Plan Credit Card is available to American Residents with a qualifying FICO credit score.

Bank of America Alaska Mileage Plan Visa Infinite (United States)

40,000 Miles Welcome Bonus

My Thoughts on the Value of the Alaska Mileage Plan Credit Card:

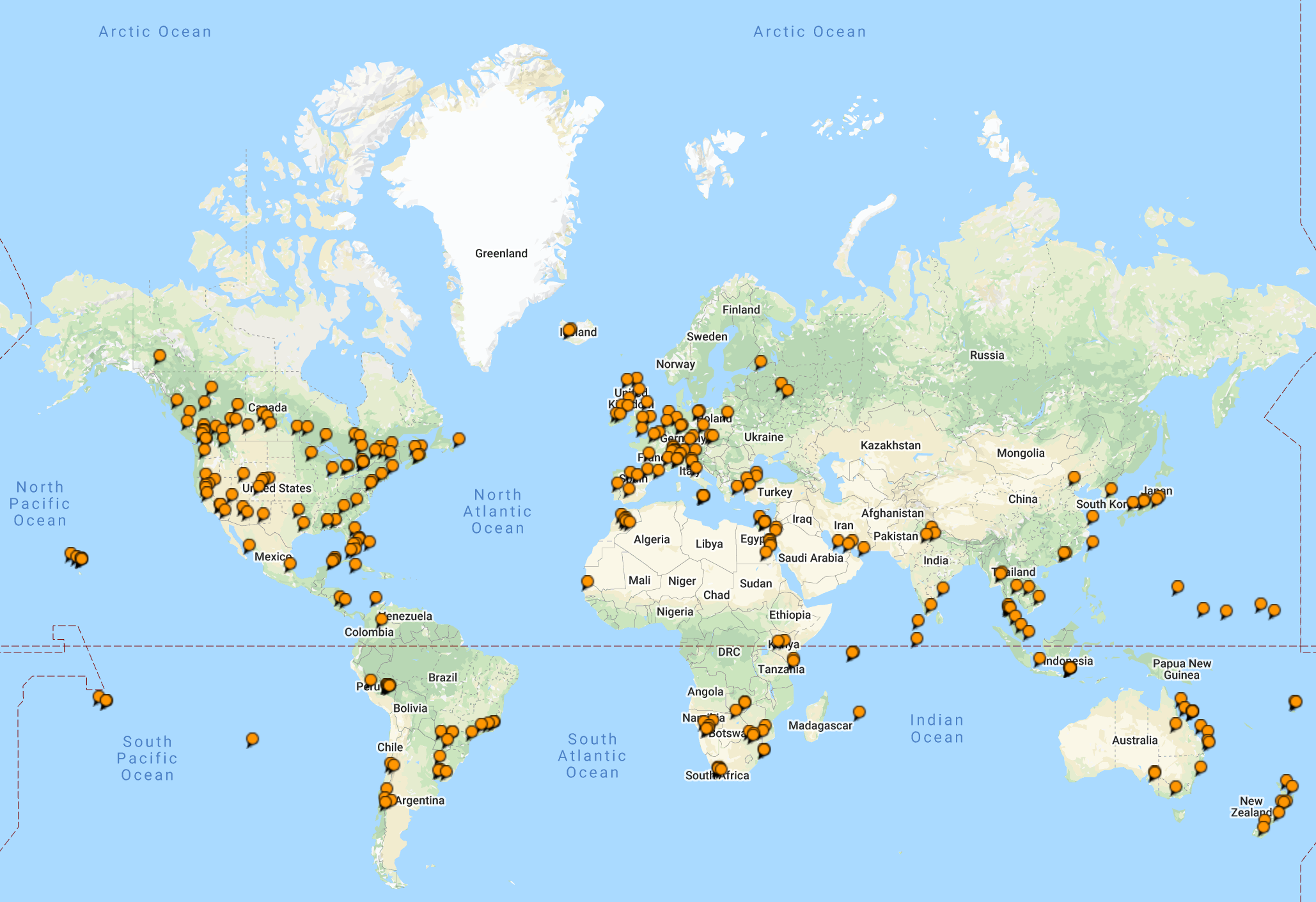

As a west coast resident that is a stone’s throw away from Alaska Airlines’ primary hub in Seattle, United States of America, I find tremendous value in holding this credit card.

The annual fee of $99 is more than outweighed by the Alaska Airlines Famous Companion Fare, and it’s pretty easily to get outsized value by using the companion fare on a round trip from the North American Mainland to Hawaii or almost any other destination in the United States.

The icing on the cake is the ability to earn frequent flier points that can be redeemed against carriers in the One World Alliance. There aren’t many credit cards in the Canadian marketplace that offer that ability, so this card easily beats the competitor cards like the RBC British Airways Visa Infinite and the RBC Cathay Pacific Visa Infinite credit card.

The only minus for this particular card would be for people that do not have Alaska Airlines serving an airport near them. Alaska Airlines has grown and expanded on the West Coast, so it could be challenging to use these benefits if you live in a region that isn’t served by Alaska Airlines.

The Bottom Line: The Alaska Airlines Mileage Plan Mastercard Credit Card

The Alaska Airlines Milage Plan Mastercard World Elite Credit Card is a must have credit card for most airline travel credit card holders, whether you are a Canadian or American resident.

The low annual fee of $99 makes it easy to get value from the card. In addition to saving on baggage fees, the Alaska Airlines Famous Companion Fare makes it easy to get outsized value from this card. Assuming you travel with a partner, the Alaska Airlines Famous Companion Fare can easily be redeemed on a trip around North America and Hawaii allowing for the traveler to get some great value with a minimum of effort.

Lastly, there can be some terrific bargains with redemptions within the Alaska Airlines Mileage Plan. Having redeemed well over a million miles from the Alaska Airlines Mileage Plan program, is a frequent flier program that I place a lot of value in having redeemed dozens of flights.

World Traveller 73

World Traveller 73

Recent Comments