Credit Card Review: American Express Platinum Business Charge Card

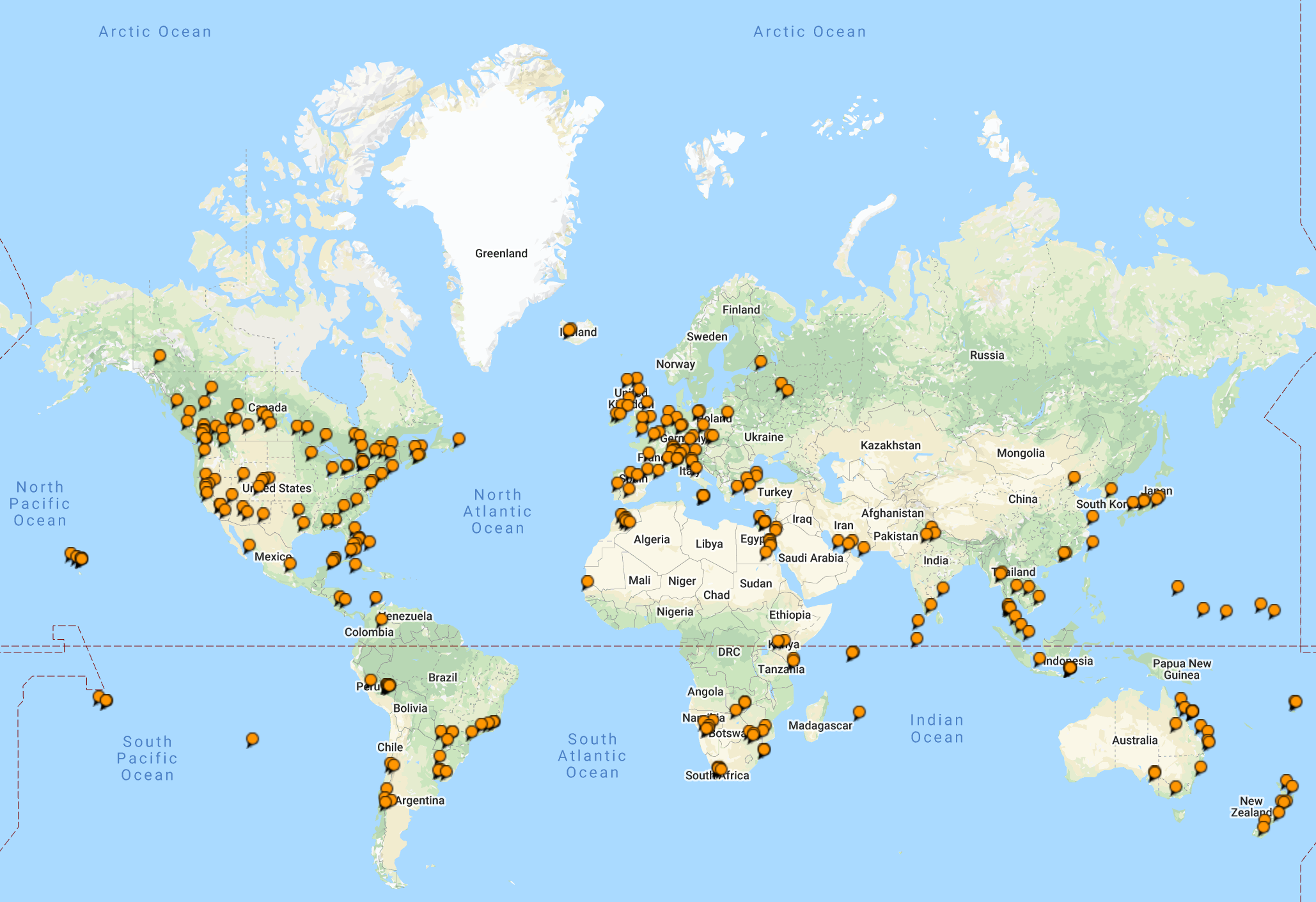

The American Express Platinum Charge Card is one of the most useful premium travel cards in the market place today. It offers some standard premium charge card features that add the most value to the card, whereas the actual earning benefits from spending on the card itself are not as exciting as they could be. It also offers access into almost any independent lounge in the world, something that isn’t offered many many credit cards.

Credit Card Review: American Express Platinum Business Charge Card

“The Leading Premium Charge Card Internationally, the American Express Platinum unlocks a lot of value provided you take the time to explore and learn all its key features.”

The American Express Platinum Card and American Express Platinum Business Charge Card are the ultimate premium credit cards in the upscale travel market today. It has had several evolutions over the years but still represents one of my favourite credit cards that I keep for the outstanding suite of benefits of offers.

The Best offer is available below through a referral link.

American Express Platinum Business (CANADA)

120,000 American Express Platinum Card Welcome Bonus with $10,000 minimum spend within the first 3 months

The charge card is issued through American Express financial institution. As a result, you don’t apply for this card from your local brick and mortar bank. You’ll likely be applying for this card directly from the American Express website, or perhaps through a referral link from a current card member.

This is a charge card that’s been in my wallet for the last several years and I find it well worth annual fee. Although the annual fee is fairly steep at $495, it does represent some solid value provided you are travelling and have the time to invest in unlocking all of the various card benefits.

As a charge card, American Express expects payment of the balance in full at the end of every reporting period. There is an opportunity to “pay over time” for a certain balance of your expenses, although this isn’t a primary feature of this card as a “charge card” category and not a credit card.

The Basics at a Glance:

The Best Offer is available below through a referral link.

Signup bonus:

Earn a welcome bonus of 120,000 Membership Rewards® points

Earn a welcome bonus of 120,000 Membership Rewards® points after you charge $10,000 in net purchases to your Card in your first three months of Card Membership. That’s $1,200 in statement credit that can be reinvested in your business.

Annual fee:

$499

Secondary Cards: $199 annually for Business Platinum Cards®; $50 annually for Business Gold Cards

Earning rate:

Earn 1.25X Membership Rewards® points

On virtually every $1 in purchases charged to your Card. Plus, earn at the same rate for virtually every dollar in purchases charged to Supplementary Cards.

Flexible Payment Option

You have the option to pay a portion of your balance over time, with interest, if you want to.

Financial Flexibility

Maximize your cash flow with up to 55 interest-free days.

There is no pre-set spending limit, and your purchasing power adjusts dynamically with your Card usage and can grow over time.

Use your points to offset expenses

Membership Rewards® allows you to offset expenses by covering the cost of purchases made on your card, in full or in part, however and whenever your business needs it.

Transfer your points, at no charge, to many frequent flyer and other loyalty programs including 1:1 to Aeroplan®and Avios.

Redeem points for flight purchases on AirCanada.com.

Referral bonus:

20,000 American Express Membership Reward Points per referral, up to a maximum of 225,000 American Express Membership Rewards per Calendar year.

Perks & benefits:

Travel the Platinum way

Explore the world with rewards, premium benefits, complimentary airport lounge access, and exclusive travel offers on American Express Travel Online.

Complimentary access to over 1,300 airport lounges worldwide. The American Express® Global Lounge Collection, includes The Centurion® Lounge network, Plaza Premium Lounges, and hundreds of other domestic and international lounges designed to enhance your travel experience. Extras at over 1,000 world-class properties in the Fine Hotels & Resorts Program

Amex offers

You can access over $1,000 in value every year with Amex Offers. Make your business purchases do more for your business with offers for dining, travel, business supplies and services, and more through the Amex App or Online Services. New offers are always being added, so be sure to check regularly.

Travel Coverage

Road trip, or flight, you could be protected when you book travel with your card.

A full suite of business solutions

From easy-to-use account management tools to help managing cash flow, it’s powerful backing that meets your business needs.

Insurance:

Above Average

Card type:

Charge card

Let’s check out the detailed benefits of this particular premium charge card…

American Express Charge Card Sign Up Bonus:

The current sign up bonus for this charge card is 120,000 American Express Membership Rewards points when you spend $10,000 CAD within the first 90 days of opening your account. This sign up bonus is much higher than it has been in the past within the Canadian market and we’ve previously seen lower sign up bonuses around 60,000 – 80,000 American Express Membership Rewards Points.

When I signed up for this card several years back, I personally got a sign up bonus of 80,000 Membership Rewards. This current offer at 120,000 Membership Rewards is substantially more generous than the sign up bonus I had access to.

Since American Express Membership Rewards convert to several frequent flier programs, including Air Canada’s Aeroplan, British Airways Executive Club Avois and Etihad Guest to name a few on a 1:1 basis, this is similar to a sign up bonus of 120,000 of your favourite airline frequent flier miles.

Admittedly, there is an attached conditional spend requirement of $10,000 within the initial three months of card membership in order to get the welcome bonus of 120,000 Membership Rewards. While this is a steep amount for some, it’s easily doable for those that have the opportunity to put some reimbursable work travel spend on their credit card. If you assume that a work trip for a week is approximately $3,000 with several days of hotel and meals, you can probably break even with just over three business trips.

American Express Annual Fee:

The American Express Platinum Business Charge Card annual fee is $499 CAD, which places it in the upper end of a premium travel card.

Globally, the annual fee is on the lower side for other American Express Platinum Charge Cards offered internationally. We’ve seen annual fees for the American Express Platinum Card range from $500 all the way up to $1,200 for some markets such as Australia. As a result, I suspect we can see an increase in this credit card’s annual fee in the not too distant future.

The card includes a suite of benefits that adds value to the card. While I kept my card throughout the pandemic when I wasn’t travelling. Admittedly, I didn’t get full value from this card when I wasn’t travelling.

American Express Membership Rewards:

The American Express Membership Rewards offers:

Earn 1.25X Membership Rewards® points on virtually every $1 in purchases charged to your Card. Plus, earn at the same rate for virtually every dollar in purchases charged to Supplementary Cards

There are no other category earning bonuses with this credit card and unlike the American Express Platinum Card personal version, all purchases are covered at the same 1.25 per $1 Membership Rewards earn rate.

This card is great to use if you need to accumulate a lot of points in a hurry, or are travelling for business. The ability to earn 1.25 points per dollar spent is pretty unprecedented in Canada and you’d have to get into the premium card markets offered by the large banks in order to compete in this area.

About American Express Membership Rewards:

The American Express Membership Rewards is the rewards program of American Express. It is a transferable points currency, that allows for redemption within American Express, or the ability to transfer to a wide range of travel, dining, entertainment and retail rewards options.

Redeeming Points

- Use points to book flights within Canada or to anywhere in the world with a fixed number of points.

- Redeem points for statement credits to offset any eligible purchase charged to your Card.

- Use points to pay for your Amazon.ca purchases at checkout.

- Use points for a wide range of gift cards and merchandise.

- Transfer points to frequent flyer and hotel programs, including one-to-one to Aeroplan® and Avios.

- Use points for flights, hotels and car rentals with American Express Travel.

- Redeem points for flight purchases on AirCanada.com.

American Express Platinum Business Charge Card Benefits:

The American Express Platinum Business Charge Card offers an excellent suite of benefits for an airline travel card.

The best feature of the American Express are the travel benefits that come along with the card. This includes a suite of travel benefits that include a comprehensive lounge access platform that includes unlimited conditional access to the American Express Centurion Lounges, in addition to preferred benefits at the American Express Fine Hotels and Resorts program.

These include the following, some of which were mentioned above:

Travel the Platinum Way:

- Complimentary Access to over 1,300 Airport Lounges Worldwide. Unlimited Access to the Global Lounge Collection, including The American Express Centurion Lounge, Plaza Premium Lounges and hundreds of other domestic and international lounges designed to enhance your travel experience.

- Access to American Express Fine Hotels and Resorts: With Fine Hotels + Resorts9, Platinum Cardmembers can receive benefits such as guaranteed 4:00 p.m. late check-out, complimentary daily breakfast for two and other benefits at over 1,100 iconic properties worldwide. Available benefits have an average total value of $550 USD* based on a two-night stay.

- Amex offers You can access over $1,000† in value every year with Amex Offers. Make your business purchases do more for your business with offers for dining, travel, business supplies and services, and more through the Amex App or Online Services. New offers are always being added, so be sure to check regularly

About Complimentary Lounge Access to 1,300 Lounges Worldwide Benefit:

The lounge access benefit of of the American Express Platinum Business card offers a complimentary Priority Pass Select membership that unlocks access to hundreds of lounges around the world. The American Express Platinum Card will get you into almost any non airline alliance lounge with the presentation of a same day boarding pass.

This lounge access benefit is remarkable convenient, and you can usually find a lounge space available at an airport near you if you don’t have access to one provided by the airline.

The availability of lounge access is one of my favourite features of this particular card. It’s among the easiest of the features to access and you don’t have to be worried about flying one particular carrier over another.

About the Amex Offers Benefit:

The Amex Offers pop into your account on an intermittent basis and offer some serious discounts

The terms and conditions for fulfilling the offer are usually listed below, in the event you want to see what items may be excluded. The American Express offers are typically valid for two to three months so with some diligent checking, you can usually plan to maximize your return on investment.

I generally get the opportunity to redeem several hundred dollars worth of offers every year. As long as you dedicate the time into checking into the offers section of the American Express website, you can usually find something good in there on a quarterly basis.

Overall, this suite of benefits offers among the largest and more comprehensive set of benefits for an elite premium travel card. The American Express Membership Rewards program offers the ability for points to be transferred to other frequent flier programs, in addition to being redeemed for other travel and even merchandise. This is a great method to stave off award devaluation, as you can move your points to a program that offers greater value.

How to Maximize American Express Membership Rewards:

In terms of American Express Membership Rewards Opportunities, we’ve made good use of the British Airways Executive Club Avios Reward program for business class flights in expensive markets at exceptionally low cost.

We have redeemed points to fly Qantas Business Class Sydney – Adelaide for 15,000 BA Avios per person, on a free ticket that is regularly $800 each.

We have also redeemed BA Avios for short haul flights crossing from Europe into Africa, when many traditional frequent flier award programs would charge a much higher category award as a result of Africa being a different continent and award zone.

We redeemed 15,000 British Airways Avios on Iberia Business Class Madrid – Marrakech and saved ourselves several tens of thousands of frequent flier points instead of using a plan like Aeroplan at the time that was charging by region and had a 30,000 premium in order to travel to Africa.

With some creative use, you can really get a lot of value for the Membership Rewards program.

Credit Card Earning Potential:

It’s possible to take a conservative look at how you can earn by using this card.

Using publicly available data from various government agencies can be used to determine both baseline income and spending averages across various categories, which we can use to compile the aggregate rewards potential for various credit cards.

Canadian Credit Card Holder Scenario:

Using Canadian data from the 2021 Census, the average income in Canada is $51,300, with a two income household at $102,600. Assuming deductions for 40% income tax, this leaves a household with $61,650 in net income.

With 40% of such expenses being charged to this credit card, $24,624 would be spent on this card earning at 1.25 per $1 spent, which would bring in 30,780 American Express Membership Rewards annually.

This is pretty much the best value card in my wallet at the moment with the ability to earn a substantial amount of points for every day spending at a much faster rate than the American Express Marriott Bonvoy personal and business credit cards.

How to Apply:

Best offer is available below through a referral link

The American Express Platinum Business Charge Card is available to Canadian residents who are of the age of majority in your province/territory of residence and have a valid credit file. There is no minimum annual income required.

American Express Platinum Business (CANADA)

120,000 American Express Platinum Card Welcome Bonus with $10,000 minimum spend within the first 3 months

My Thoughts on the Value of the American Express Platinum Business Charge Card:

The American Express Platinum Card is a card that I find delivers a lot of value.

I tend to run almost all my business expenses through this card. I also find that, when travelling, I tend to use a lot of the benefits that come with the card. These great benefits include a large lounge access network and even include discounted codes for Hertz car rental. We use the benefits so much, even MrsWT73 has an additional card as an authorized user.

As a result, this is a card that I continue to keep in my wallet.

The Bottom Line: The American Express Platinum Business Charge Card

The American Express Platinum Charge Card offers great value into a premium travel card. The American Express Global Lounge Collection offers access to it’s own collection of Centurion Lounges, in addition to a Priority Pass membership

It’s also a great feature to be able to transfer your American Express Membership Rewards points to a number of frequent flier programs.

World Traveller 73

World Traveller 73

Recent Comments