Credit Card Review: Toronto Dominion Aeroplan Visa Infinite Credit Card

The Toronto Dominion Aeroplan Visa Infinite Credit Card is one of the more common airline credit cards in the market place today. It offers a reasonable amount of features for an airline credit card including the ability to earn 1.5 points per dollar spent on Air Canada purchases.

If you enjoyed this post, please follow us here or on social media through Facebook, Twitter or Instagram for more travel tips and hacks on how to “Upgrade Your Travels”.

Credit Card Review: Toronto Dominion Aeroplan Visa Infinite Card

“The Credit Card for those that aren’t travelling everyday, that still want to earn Air Canada Aeroplan points”

The Toronto Dominion (TD) Aeroplan Visa Infinite Card is a solid airline travel credit card that features a competitive series of benefits.

APPLY NOW – TD Aeroplan Visa Infinite Card – Up to 50,000 Welcome Bonus

TD Aeroplan Visa Infinite Card (CANADA)

Up to 50,000 Air Canada Aeroplan Miles Welcome Bonus

For our Canadian readers, this credit card is issued through Toronto Dominion (TD) Bank as the TD Aeroplan Infinite Visa Credit Card.

For our American readers, this credit card not available in the United States of America. However, it is possible to earn into Air Canada Aeroplan by getting an Air Canada Aeroplan Visa Card issued in the United States through the Chase Aeroplan Mastercard.

The TD Aeroplan Visa Infinite Card is a credit card that’s been in my wallet for many years now and is probably worth the annual fee. It offers the opportunity to earn on the largest air carrier in Canada: Air Canada and allows for redemption against the Star Alliance network.

The Basics at a Glance:

Signup bonus:

Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card

Earn 20,000 Aeroplan points when you spend $1,500 within 90 days of Account opening

Plus, earn an additional 20,000 Aeroplan points when you spend $7,500 within 12 months of Account opening

Annual fee:

$139 CAD

Earning rate:

Earn 1.5 points: for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

Earn 1 point: for every $1 spent on all other Purchases made with your Card

Earn points twice: Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore.

Earn 50% more Aeroplan points at Starbucks when you link your TD card with your Starbucks® Rewards account.

Referral bonus:

None

Perks & benefits:

- Travelling lightly through the airport and saving on baggage fees. Primary Cardholders, Additional Cardholders, and travel companions (up to eight) travelling on the same reservation will all enjoy their first checked bag free (up to 23kg/50lb) when your travel originates on an Air Canada flight.

- Enroll for NEXUS and once every 48 months get an application fee rebate (up to $100 CAD). Additional Cardholders can also take advantage of this NEXUS fee rebate.

- For a limited time, enroll to get a free Uber Pass membership for 6 months. Offer ends September 7, 2022.

- Your Aeroplan points will not expire as long as you are a TD® Aeroplan® Visa Infinite Primary Cardholder in good standing

Insurance:

Average

Card type:

Credit card

Let’s check out the detailed benefits of this particular airline credit card…

TD Aeroplan Visa Infinite Credit Card Sign Up Bonus:

The current sign up bonus for this credit card is on a carefully scripted and staggered basis. The sign up bonus offers a welcome bonus of 10,000 Air Canada Aeroplan Miles after your first purchase.

The card offers a 20,000 Air Canada Aeroplan points when you spend $1,500 CAD within the first 90 days of opening your account.

Lastly, you can earn an additional 20,000 Air Canada Aeroplan points after spending $7,500 CAD within 12 months of account opening.

This represents a total value of 50,000 Air Canada Aeroplan miles within the first year assuming you meet the requirements.

A 50,000 Air Canada Aeroplan sign up bonus is a pretty solid sign up bonus by Canadian standards; assuming you have the time, effort and energy to track your progress. It is typically higher than the usual 25,000 point / mile sign up bonuses that we have seen in the past in the Canadian market place.

TD Aeroplan Visa Infinite Annual Fee:

The TD Aeroplan Visa Infinite annual fee is $139 CAD, which places it in the upper end of an everyday airline travel card.

The annual fee is on the higher side for a premium travel card. If you are aiming for a travel airline credit card, you’re going to be paying somewhere between $125 – $150 CAD for an annual fee which makes a $139 CAD annual fee towards the top end of this range by today’s standards.

The card is in the Visa Infinite line of credit cards. This means that it is among the higher end of Visa cards.

Earn Air Canada Aeroplan points:

The TD Aeroplan Visa Infinite Card offers:

Earn 1.5 Air Canada Aeroplan points: for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

Earn 1 Air Canada Aeroplan point: for every $1 spent on all other Purchases made with your Card

Earn points twice: Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore.

Earn 50% more Aeroplan points at Starbucks when you link your TD card with your Starbucks® Rewards account.

Earning one point per dollar is a pretty typical earn rate for an airline credit card. I do find that earning 1.5 Aeroplan points per dollar on grocery and gasoline purchases is a pretty good rate of return by Canadian standards.

While I would normally recommend earning towards a transferable points currency, the reality is that (within Canada) there aren’t many that earn at a 1.5 rate right off the top. As a result, this tends to be the card that I pull first if I am at Safeway, Save – On – Foods or gassing up at Shell or Esso, within Canada.

TD Aeroplan Visa Infinite Benefits:

The TD Aeroplan Visa Infinite credit card offers a usual suite of benefits for an airline travel card.

These include the following, some of which were mentioned above:

- No Checked Bag Fees: Travelling lightly through the airport and saving on baggage fees. Primary Cardholders, Additional Cardholders, and travel companions (up to eight) travelling on the same reservation will all enjoy their first checked bag free (up to 23kg/50lb) when your travel originates on an Air Canada flight.

- Nexus Application Fee Rebate: Enroll for NEXUS and once every 48 months get an application fee rebate (up to $100 CAD). Additional Cardholders can also take advantage of this NEXUS fee rebate.

- Free Uber Pass Membership: For a limited time, enroll to get a free Uber Pass membership for 6 months. Offer ends September 7, 2022.

- No expiration of points: Your Aeroplan points will not expire as long as you are a TD® Aeroplan® Visa Infinite Primary Cardholder in good standing

While I tend to book Air Canada Flex Fare tickets (which include checked bag fees), I find I don’t get a lot of use out of the no checked bag fees. I generally try to fly “carry on only” so admittedly, I don’t find this feature to be all that useful.

The primary reason for owning this card is the ability to earn points into the Air Canada Aeroplan program. The Air Canada Aeroplan program offers access into redemptions into Star Alliance; the world’s largest airlines network.

Visa Infinite Benefits:

As an upscale credit card, the TD Aeroplan Visa Infinite Card is part of the Visa Infinite brand of cards. The Visa cards range from Visa Classic -> Visa Gold – Visa Premium -. Visa Infinite -> Visa Infinite Privilege.

The TD Aeroplan Infinite Card is towards the higher end of these cards being one level down from the top.

Visa Infinite Luxury Hotel Collection

With Visa Infinite, you can enjoy benefits like room upgrades, complimentary WiFi and breakfast, late checkout and more at over 900 Visa Infinite Luxury Hotel Collection properties around the world.

Dining and Wine Country:

Get access to exciting culinary experiences from some of the finest restaurants across Canada. Experience an evening of cooking with renowned chefs, sommeliers and/or mixologists as they guide you through each course with wine/cocktail pairings for an evening of great food and entertainment.

Complimentary Concierge:

Visa Infinite includes a Complimentary Concierge service. Your Concierge can help you with planning the perfect travel itinerary, birthday, or your next great idea. Available 24/7 at 1-888-853-4458.

While the Visa Infinite program offers opportunities similar to American Express, I find thatI don’t really use the program as much as possible. It is also marketed a lot less than the other programs with a lot less properties and opportunities on offer by comparison.

Air Canada Aeroplan Opportunities:

In terms of Air Canada Aeroplan Opportunities, the program offers access to a great number of awards. With a recent switch to a distance based model, there remain some good opportunities around the world.

One of the best redemptions for those with the flexibility to travel at the last minute (or switch travel) is Lufthansa First Class from North American to Germany and beyond.

You can redeem Air Canada Aeroplan miles for fully flat seats on All Nippon Airways in Staggered Business with world class service from North America to Asia.

Another great option is a redemption on Turkish Airlines Business Class from North American to Europe and beyond.

Back in the day, Thai Airways First Class with almost unlimited Dom Perginon, a full Thai massage, and golf cart transfers at Suvarnabhumi International Airport in Bangkok Thailand, were the award of the day.

Ultimately, I simply haven’t found another airline alliance that has as many available opportunities as Star Alliance. The TD Aeroplan Visa Infinite program offers earning into Aeroplan that allows for access into these streams.

in addition to the earning abilities into Air Canada Aeroplan, the fact that this card is a Visa Infinite card means that it is accepted almost everywhere, and there isn’t anywhere that’s going to turn you down as compared to American Express which has less merchant acceptance in my area.

Credit Card Earning Potential:

It’s possible to take a conservative look at how you can earn by using this card.

Using publicly available data from various government agencies can be used to determine both baseline income and spending averages across various categories, which we can use to compile the aggregate rewards potential for various credit cards.

Canadian Credit Card Holder Scenario:

Using Canadian data from the 2021 Census, the average income in Canada is $51,300, with a two income household at $102,600. Assuming deductions for 40% income tax, this leaves a household with $61,650 in net income.

With 40% of such expenses being charged to this credit card, $24,624 would be spent on this card, which would bring in 24,624 Air Canada Aeroplan Points annually.

If you add a $1,000 airfare after use of the Air Canada earning bonus of 1.5 points per dollar earned, you’d add another 1,500 Air Canada Aeroplan points for an annual potential return of 27,624 Air Canada Aeroplan Points.

How to Apply:

The TD Aeroplan Visa Infinite credit card is available to Canadian residents who are of the age of majority in your province/territory of residence. Your Personal annual income must be greater than $60,000, or household annual income must be $100,000 or greater.

TD Aeroplan Visa Infinite Card (CANADA)

Up to 50,000 Air Canada Aeroplan Miles Welcome Bonus

My Thoughts on the Value of the TD Aeroplan Visa Infinite Credit Card:

As a west coast Canadian resident that is situated in one of Air Canada’a hub cities, I find myself always travelling Air Canada for business reasons and occasionally for pleasure. I find reasonable value in holding this credit card; enough value to keep the card in my wallet.

The annual fee of $139 is reasonably expensive compared to its competitors in the market. The card attempts to position itself as an every day card of interest to many Canadian consumers who will likely have only one travel card in their wallet.

The category bonus for grocery and gas of 1.5 points per dollar spent means that many every day and non travelling consumers stand to earn as substantial amount of points while they enjoy life at home in their communities. This may not be the best card for every day business road warriors, who aren’t at home to purchase gas or groceries and able to earn under these categories. To be frank, when I’m on the road – which is often, I tend to put my hotel, restaurant and other travel spend on the American Express Marriott Bonvoy credit cards as the earn rates are much higher.

The Bottom Line: The TD Aeroplan Visa Infinite Credit Card

The TD Aeroplan Visa Infinite credit card is a great everyday card that is designed for the majority of customers residing in Canada.

While the category bonuses on this card for gas and grocery stores are targeted to those that actually travel less, there can be some value in maintaining this card for those that spend more time around the neighbourhood, instead of actually out on the road.

Lastly, this is the card to have within Canada if you want to keep your Air Canada Aeroplan account active. Since I go to American Express The Platinum Card for my premium travel card, the main reason I keep the TD Aeroplan Visa, is because it’s a reasonable annual fee and there are just times when you need to pay by Visa.

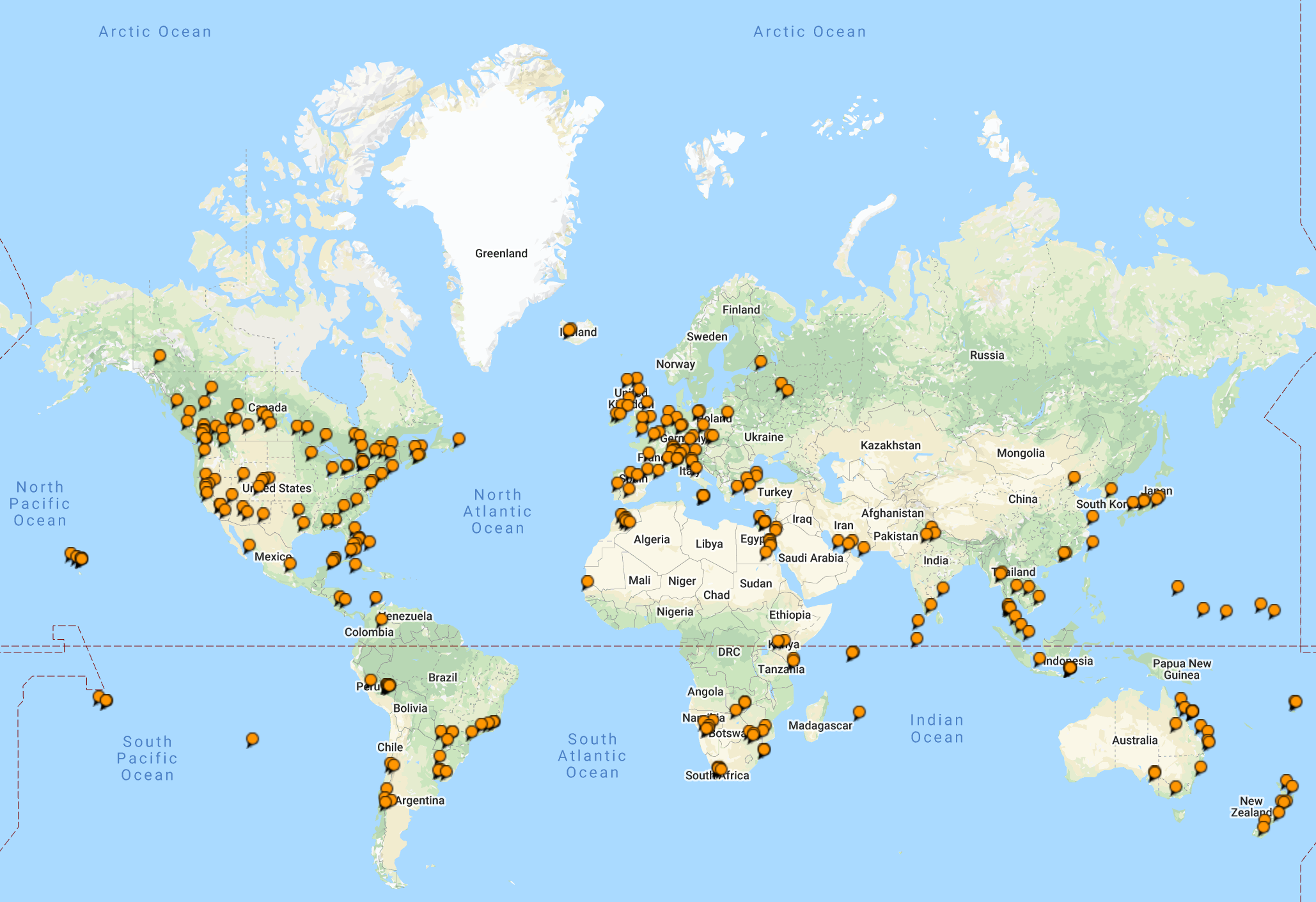

World Traveller 73

World Traveller 73

Recent Comments