MBNA Cancels the Alaska Airlines Mastercard

The credit card frequent flier points earning environment never seems to stay the same for very long. Today, we’ve learned of a major change upcoming change for the MBNA Alaska Airlines World Elite Mastercard. MBNA has announced the end of the MBNA Alaska Airlines World Elite Mastercard and is planning to transition its customers to MBNA Rewards World Elite Mastercard. Read on to see what is in store for current cardholders and what details of the transition look like.

MBNA Cancels the Alaska Airlines Mastercard; Cardholders To Be Converted to MBNA Rewards World Elite Mastercard

MBNA (Toronto Dominion Bank) has announced they are cancelling the MBNA Alaska Airlines Mastercard and converting cardholders to the MBNA Rewards World Elite Mastercard.

What is the MBNA Alaska Airlines Mastercard?

The MBNA Alaska Airlines Mastercard was an exceptionally useful credit card for Canadian Credit Card holders. For our Canadian readers, this credit card is issued through MBNA (owned by Toronto Dominion Banking) as the Alaska Airlines Mileage Plan World Elite Mastercard Credit Card.

The Current MBNA Alaska Airlines Mastercard Benefits:

The card offered a host of travel benefits that included the following:

- a sign up bonus of 30,000 Alaska Mileage Plan miles, upon spending $1,000 CAD in the first three months

- An earn rate of 3 Alaska Mileage Plan points per dollar spent on Alaska Airlines

- An earn rate of 1 Alaska Mileage Plan points per dollar on everything else

- Annual Alaska Airlines Famous Companion Fare (2 for 1)

- A Free Checked Bag for Up to 6 Travellers on the Same Reservation

- An Annual Fee of $99

This card was especially valuable as it was one of the few Canadian Credit Cards that allowed direct spending accumulation onto a United States based frequent flier program airline; something that no other Canadian credit card currently offers.

Since Alaska Airlines- a Member of the One World Alliance, was a competitor to Air Canada’s Star Alliance, having a credit card that allowed for points accumulation in a competing frequent flier program allowed for a really nice balance between the two programs. With a healthy mileage balance in both programs, you could often find reward space in one program, when you could not find space in the other.

The MBNA Alaska Mileage Plan Mastercard was exceptionally valuable and had become the card that I’d typically pull second, assuming my American Express Platinum Card was not accepted by the merchant.

MBNA Closes the Alaska Airlines Mastercard Card to New Applications:

A few months ago, MBNA quietly stopped accepting new applications for the MBNA Alaska Airlines Mastercard on the MBNA website. While this deletion was not publicly announced, it seemed from that point on, that the future of the MBNA Alaska Airlines Mileage Plan card was in jeopardy.

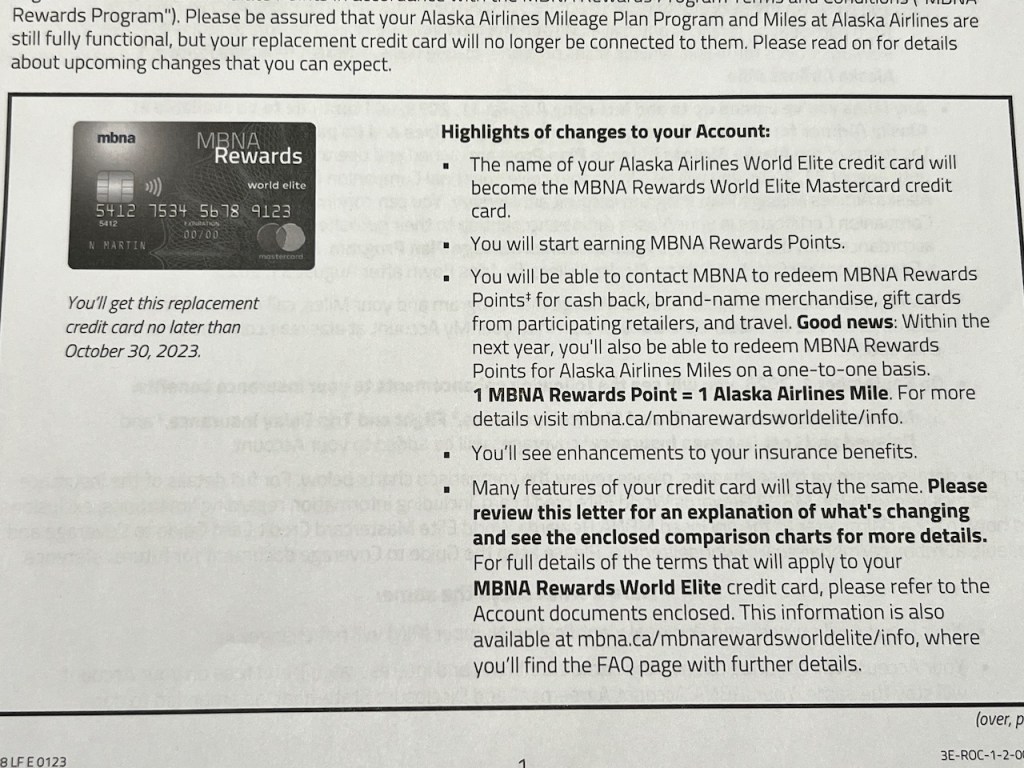

Returning home from work today, I received a very plain looking envelope in the mail outlining the changes. MBNA went very basic on announcing the changes, in an envelope that seemed to have all the excitement of an updated credit card holder agreement.

Fortunately, there may be a silver lining amongst these changes.

MBNA Cancels the Alaska Airlines Mileage Plan Mastercard:

Plans to Transition all Cardholders to the MBNA Rewards World Elite Mastercard

In a letter to cardholders, MBNA has announced that on August 31, 2023, the relationship between Alaska Airlines and the card issuer MBNA (The Toronto Dominion Bank operating a division as MBNA) is ending.

MBNA has also posted the changes on their website outlining what is changing.

Details of the Conversion & What’s Changing to the Card:

Starting on September 1, 2023, the MBNA Alaska Airlines Mastercard will be replaced by the MBNA Rewards World Elite Mastercard. Under the MBNA Rewards World Elite Mastercard, the card holder account will no longer be able to be able to earn Alaska Airlines Mileages under the Alaska Airlines Mileage Plan program.

Card holders were assured that their Alaska Airlines Mileage Plan program and miles at Alaska Airlines are still functional, but the replacement credit card will no longer be connected to them.

Instead, MBNA Rewards World Elite cardholders will be able to start earning MBNA Rewards Points.

MBNA Rewards World Elite Card holders will be able to redeem MBNA Rewards for cash back, merchandise, gift cards and travel.

MBNA Rewards World Elite Card Holders will also “within the next year, be able to redeem MBNA Rewards Points for Alaska Airlines Miles on a one – to one basis“. Specifically, 1 MBNA Rewards Point = 1 Alaska Airlines mile.

MBNA Rewards World Elite Card Holders will earn 5 points for every dollar for eligible purchases up to $50,000 annually (each) in the following categories

- Restaurant

- Groceries

- Digital Media (for example: e-books, movies and music)

- Memberships (for example: gym and club memberships)

- Household Utility (for example: cable, phone and utility payments)

MBNA Rewards World Elite Card Holders will earn 1 points for every dollar for every other category.

MBNA Rewards World Elite Cardholders will also receive an annual birthday bonus of 10% of all the MBNA Rewards Points earned in the 12 months prior to the Primary Cardholders

Any Alaska Airlines Mileage Plan miles earned up to and including August 31, 2023 will continue to be available at Alaska Airlines to be redeemed for travel on Alaska Airlines and its partners.

Up until August 31, 2023, you will be able to receive the final Alaska Airlines Companion Certificates based on your Alaska Airlines account anniversary. These can continue to be used to their published expiration dates.

Card Members will no longer receive a complimentary checked bag on Alaska Airlines after August 31, 2023. If you have Alaska Airlines MVP, MVP Gold, or any level of One World Status (Ruby, Emerald or Sapphire), you’ll be exempt from this fee.

MBNA is offering customers who are not in agreement with this change the option to cancel their cards without cost by contacting them prior to September 1, 2023.

MBNA is stating that “within the next year” cardholders will be able to transfer MBNA Rewards Points to Alaska Airlines Mileage Plan miles on a 1 to 1 basis. MBNA did not provide any further details on this proposal, but I would imagine this will be integrated into it’s MBNA Rewards portal at some point in the future.

Summary of the MBNA Rewards Card Changes:

MBNA outlined a table of the changes effective September 1, 2023. The table sets out clearly the differences between today’ card, and what can be expected after September 1, 2023.

| What’s Changing | Current – MBNA Alaska Airlines World Elite MasterCard | New – MBNA Rewards World Elite Mastercard |

| Rewards Program: | Alaska Airlines Mileage Plan Miles | MBNA Rewards Points |

| Base Earn Rate: | 1 Mile / $1 on Net Purchase | $1 point / $1 on net purchase 1 Point for every dollar in purchases |

| Bonus Earn Rates: | Additional 2 miles per / $1 on purchases of Alaska Arlines Mileage Plan tickets, vacation packages, and cargo purchases | $5 points / $1 on eligible restaurant, grocery, digital media, membership and household utility purchases, until $50,000 is spent annually in the applicable category |

| Birthday Bonus: | Not Applicable | 10% of the total number of point the account earned in the 12 months preceding the primary cardholder’s birthday month |

| Other Rewards: | Companion Certificates Complimentary Checked Bag | REMOVED: No Compantion Certificates Provided No Complimentary Checked Bag Provided |

| Redemptions: | All redemptions must be made through Alaska Airlines Mileage Plan | Redemptions are made through MBNA Rewards and can be made for travel purchases, cash redemption options, other redemption options. These include: 100 points / $1 to pay for a travel purchase cost 120 points / $1 in cash rewards (minimum 6,000 points required to redeem) |

| Insurance Benefits: | Rental Vehicle Benefits Common Carrier Accidental Death and Dismemberment Benefits Unexpected Return Home Purchase Assurance and Extended Warranty Legal Assistance Trip Assistance | NEW: Mobile Device Instuance; coverage up to $1,000 NEW: Travel Medical Insurance; up to $2,000,000 New: Flight & Trip Delay Insurance; up to $500 in coverage NEW: Delayed and Lost Baggage Insurance; up to $1,000 |

Interestingly, MBNA didn’t include the ability to convert MBNA Rewards points into Alaska Airlines Mileage Plan miles in the included chart. MBNA promises that this will occur “sometime in the next year”.

My Take on These Proposed Changes:

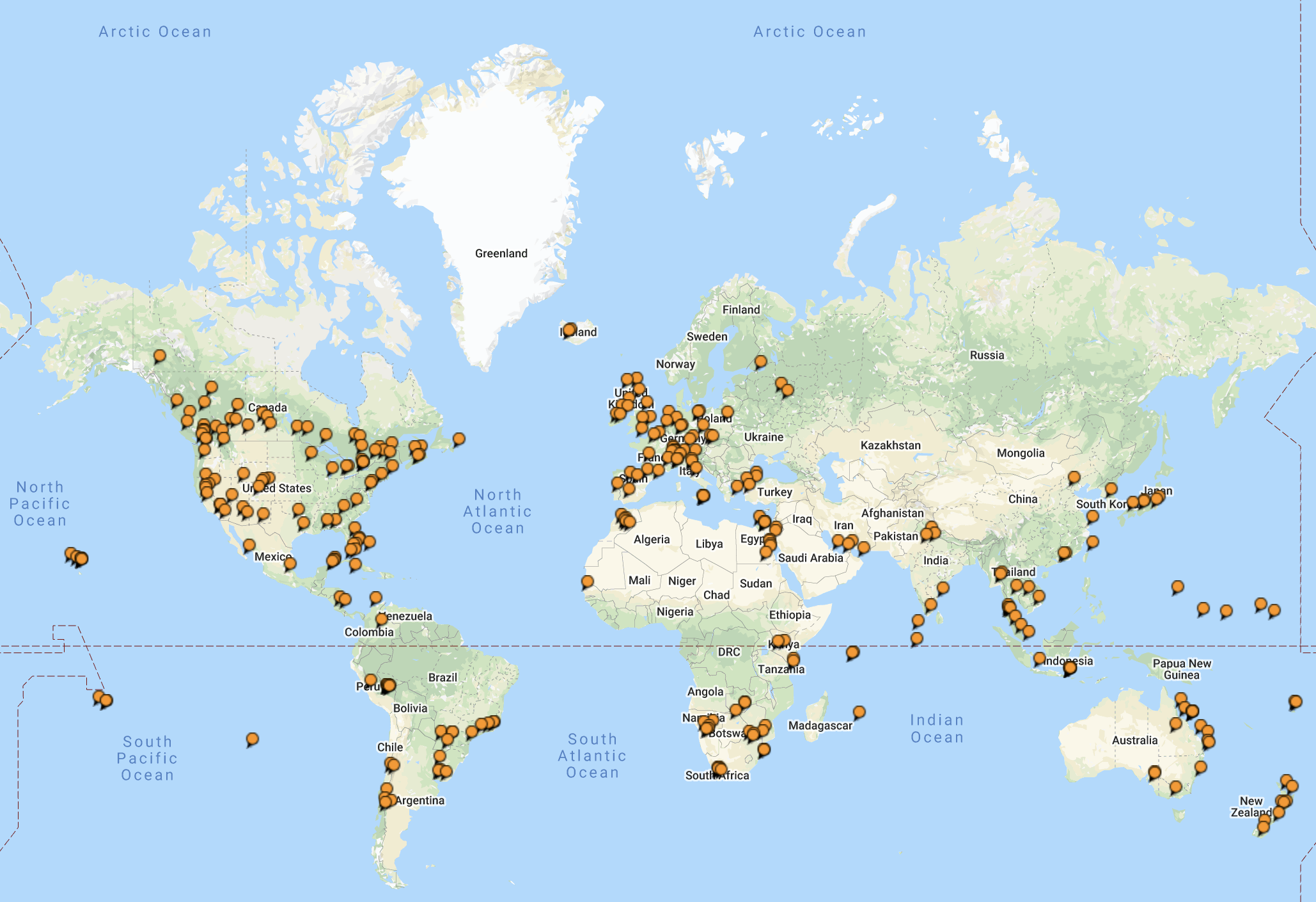

I was really disappointed to see the end of the MBNA Alaska Airlines Mileage Plan Mastercard. Although Alaska Airlines served mostly West Coast destinations such as Vancouver, Kelowna, Calgary and Edmonton in Canada, I was still able to get a lot of miles out of this credit card.

The MBNA Alaska Airlines Mileage Plan credit card was exceptionally valuable for my travel patterns by allowing high value redemptions on Alaska Airlines, a great companion fare, along with the ability to earn miles on an US Based carrier’s frequent flier program, in my home country of Canada.

There is a silver lining in that, “sometime next year” there is likely the functionality to be added to convert MBNA Rewards Points into Alaska Airlines Mileage Plan miles. While this isn’t as direct as earning direct into your Alaska Airlines Mileage Plan account, I would imagine MBNA will need to finalize this agreement with Alaska Airlines and set up an IT portal to allow for these point conversions. MBNA Reward Elite customers will likely have the ability to request the conversion of miles, which will likely arrive in an Alaska Airlines Mileage Plan account sometime shortly thereafter.

If this conversion proceeds as planned, then the new card will likely earn a little higher rate at 5 points per $1 at Restaurants, Grocery Purchases and Utility purchases. This is a slightly better earn rate than the TD Infinite Visa Aeroplan Credit Card, that only earns 1.5 points for every $1 spend on groceries. While there is the possibility to be in a better earning circumstance leveraging the 5 points per dollar categories, this will likely require a lot of work and attention to your spending patterns.

Assuming the ability to convert the card’s new MBNA Reward points to Alaska Airlines Mileage Plan frequent flier points is actually established, then I’d rate these changes as neutral. The loss of the Alaska Airlines Companion Fare is a substantial blow to the value of this card. While the ability to convert points to Alaska Airlines may remain, the ability to convert points to miles likely involves a conversion delay as points are probably batch processed, which makes it less convenient to redeem instant rewards.

Before I keep or cancel this particular card, I’ll have to rate this as a “wait and see” situation. I can’t see continuing with an MBNA Reward card, unless the ability to convert to Alaska Airlines Mileage Plan is established rather quickly.

In Summary: MBNA Sunsets the Alaska Airlines Mileage Plan Mastercard

MBNA has announced the end of the Alaska Airlines Mastercard for it’s Canadian customers. MBNA plans to transition it’s card holders to the MBNA Rewards World Elite Mastercard, with a possible future ability to convert the points into Alaska Airlines Mileage Plan frequent flier program.

While there are enhanced earning categories for five times the points in the restaurant, grocery and utilities categories, this comes at the cost of a conversion portal in order to re-claim Alaska Airlines points that is going to be set up “sometime in the future”.

Ultimately, we’ll have to watch how this transition proceeds, in order to determine whether their remains any value left in this card.

World Traveller 73

World Traveller 73

I never used the companion fare as Alaska flights out of YVR were more expensive and less convenient than Westjet/AC, at least for my travel pattern. But this change will be huge if true, this will beat cobalt with potential earning of 5.5 miles/dollar. I don’t see any other cards coming close and don’t know how MNBA can make it work financially.

LikeLike

I am guessing that MBNA is betting on the majority of card holders keeping their points with the MBNA Rewards rewards program, and not effecting a transfer to Alaska Airlines. This way, MBNA can set MBNA reward redemptions at whatever level they choose.

It is also possible we will see MBNA adjust the transfer points ratio from one to one to a lower ratio. This would be comparable to the RBC Avion Visa transfer ratio of Avion to American Airlines AAdvantage at 1: 0.7 points

I’m taking a bit of a wait and see approach with this one. I certainly will miss those companion fares!

LikeLike

Well, the documents I received today indicate only 2 points/$1. The restrictions on which items you will receive this is going to drastically reduce your accumulated points. I will be changing to Westjet, they have actually improved their mileage plan. MBNA has made a huge mistake.

LikeLike

Well, I hope that MBNA doesn’t adjust the redemption ratios out of competitiveness. The limited marketing currently does seem to suggest a 1:1 ratio. However, there were several levels of the Alaska Airlines Mileage Plan Card; from World Elite to Platinum Plus. Let’s hope that it’s a flat rate across all the MBNA Reward cards.

Otherwise, RBC will benefit from many defections over to the RBC Westjet Visa, which offers similar benefits.

LikeLike

Has anyone read the terms of the 5pts for grocery/restaurants? I read only if the merchant uses the correct reference number? I asked Mbna about this and it’s up to the merchant and you can’t see the code they use on your statement. Just don’t want to use this card for 5 x the points if none of my reg purchases use the correct “ reference” code to qualify?!

LikeLike

This is a common issue that I’ve currently got on the American Express Marriott Bonvoy Business Credit Card. It offers 3x points in eligible gas, dining and travel and 2x base points earn.

I’ve had to use the “guess and check” method for several purchases. Generally, I have to remember the locations that offer the 3x bonus and which offer the base earn.

It’s been specific enough that a spa in a hotel doesn’t qualify for the bonus, but the hotel at the front desk does. Obviously, it’s not ideal but perhaps the MBNA Reward point category bonuses are worth the inconvenience to you.

LikeLike