I (finally) applied for an American Express Cobalt Card; here’s what happened.

Sometimes, things change in the credit card earning environment. When MBNA cancelled the MBNA Alaska Airlines Mileage Plan Mastercard, I stuck with the replacement MBNA Rewards World Elite Mastercard until a major benefit was removed. I ended up looking for another credit card earning opportunity and ended up landing on the popular American Express Cobalt Credit Card. Read on to see how I ended up coming to this conclusion, and how my application process went.

If you enjoyed this post, please follow us here or on social media through Facebook, Twitter “X” or Instagram for more travel tips and hacks on how to “Upgrade Your Travels”.

I (finally) applied for an American Express Cobalt Card: here’s what happened

The American Express Cobalt Card had been on my radar since it’s inception. However, it’s initial launch offering a lessor diluted Membership Rewards Select points category didn’t seem appealing to me. As a result of lessor acceptance of American Express Cards, I ended up putting off applying for this card until recently. This is the story of how I ended up at this credit card intersection and cross roads.

Cancelling my MBNA Rewards World Elite Mastercard:

When MBNA decided to cancel their MBNA Alaska Airlines Mastercard, they decided to replace it with an MBNA Rewards World Elite Mastercard. It even came with a sign up “loyalty” bonus with the promise to be able to covert MBNA Rewards points to Alaska Airlines Mileage Plan miles on a 1 : 1 basis in the future.

I ended up sticking with the MBNA Rewards World Elite Mastercard for about a year. Much like similar cards in this category, the MBNA Rewards World Elite Mastercard offered generous category bonuses.

The MBNA Rewards World Elite Mastercard earned 5 points for every $1 spent on eligible restaurant, grocery, digital media, membership, and household utility purchases until $50,000 is spent annually in the applicable category, followed by 1 point for every $1 on all other eligible purchases. The card also offered a Birthday Bonus equal to 10% of the total number of Points the Account earned in the 12 months before the month of the primary cardholder’s birthday, to a maximum Birthday Bonus each year of 15,000 Points.

Under this combination, I picked up about 80,000 MBMA Rewards points in the first year alone. Unfortunately, MBNA would later announce that the conversation of points from MBNA Rewards to Alaska Airlines Mileage Plan miles would change to a “one time” offer. This was opposed to a standing agreement similar to RBC Avion Visa and British Airways Executive Club when transfers can be made at any time and occasionally offer seasonal transfer bonuses.

I didn’t see much thrill or value in exchanging MBNA Rewards points for dynamic pricing into economy class cabins on the MBNA Rewards booking engine. Without the ability to transfer MBNA Rewards points into Alaska Airlines Mileage Plan, it made the MBNA Rewards card completely irrelevant to my leisure travel needs.

Given the end of this earning opportunity, I decided I needed to explore a new card opportunity.

Why American Express Cobalt?

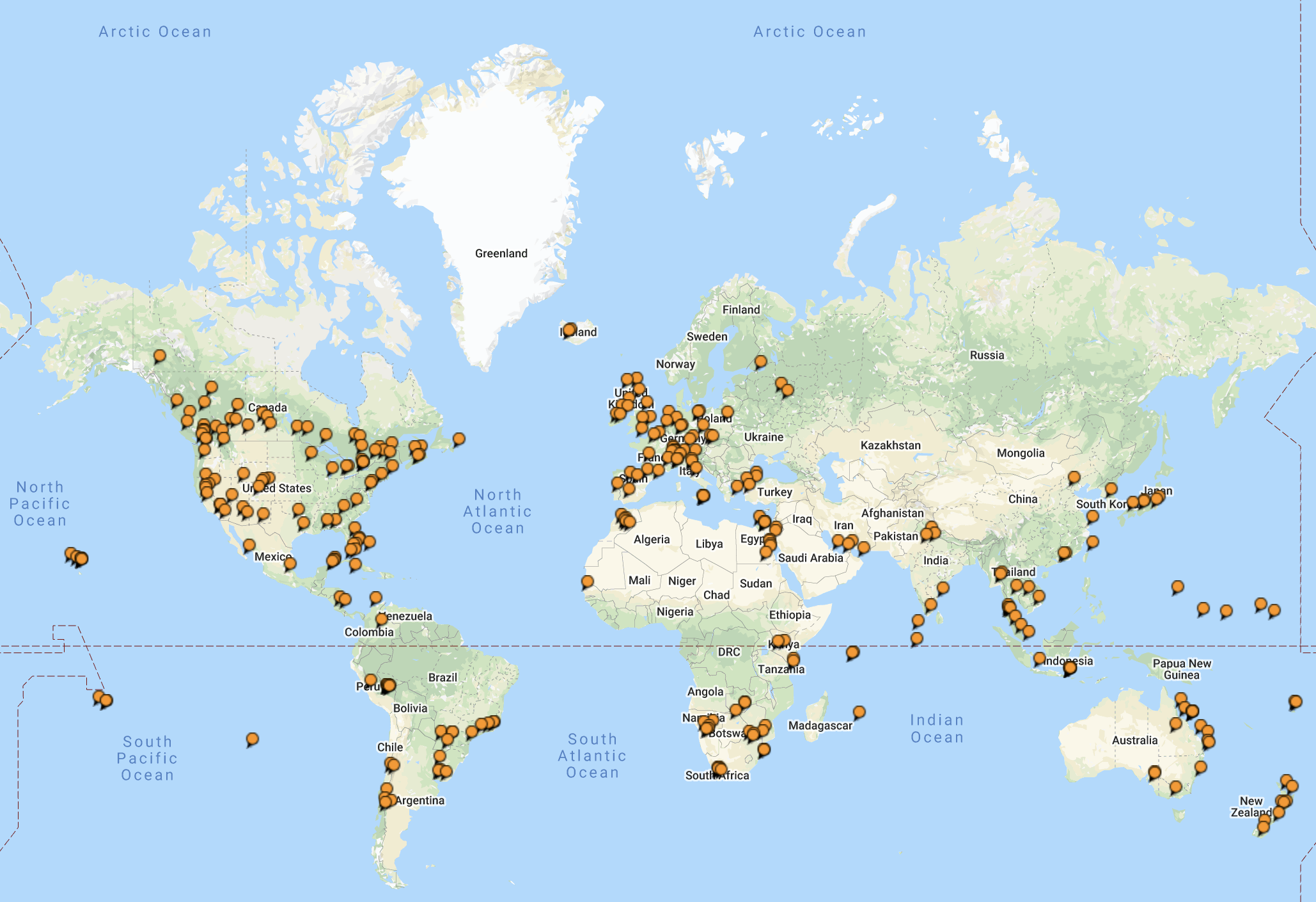

I ended up enjoying the restaurant category bonuses found on the MBNA Rewards card. As a corporate traveller, I end up spending a lot of time on the road. It seems that every month, I am out dining in restaurants – sometimes a week at a time. Much of it is reimbursed from my employer, through our generous travel policy.

The American Express Cobalt made sense to add value into my earning stream, given that it offered the following earning opportunities:

- 5X points earn on “eats and drinks” such as eligible restaurants or food delivery in Canada.

- 3X points on streaming subscriptions, in Canada.

- 2X points on gas, transit and ride share purchases, in Canada.

The fine print reveals that these category bonuses are only valid for purchases “within Canada”. As a result, this doesn’t offer the total value of an American Express Business Platinum Card that usually earns full bonuses on every category internationally.

For those that are travelling from Canada within the United States, this might not be your ideal set up. As a mostly domestic traveller, within Canada, I’d still expect to see some value.

Applying for an American Express Cobalt Card:

With a fall travel schedule, I ended up looking to pick up a Cobalt Card as I entered the fall business travel season. Unfortunately, I wasn’t in a position to wait around for a larger sign up bonus given a quarter cycle of travel expenses coming up.

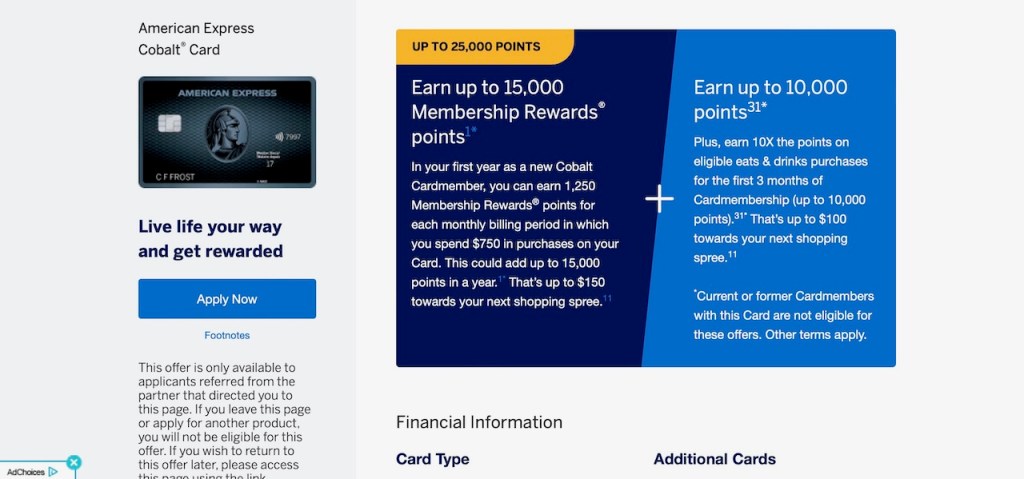

I searched around for the best available sign up bonus. American Express was offering a forward public facing sign up bonus of 15,000 American Express Membership Rewards points.

However, Perkopolis (Canada’s Largest Employee Perks provider) was offering a slightly better offer with 15,000 American Express Membership Rewards points, with an extra bonus of an additional 10,000 American Express Membership Rewards points on eligible eats and drinks within the first three months of card membership. This was a potential earn of 25,000 Membership Rewards points within the first year.

The 15,000 Membership Rewards welcome bonus was conditional on meeting $750 CAD of minimum spend per month; split into 1,250 Membership Rewards points across twelve months.

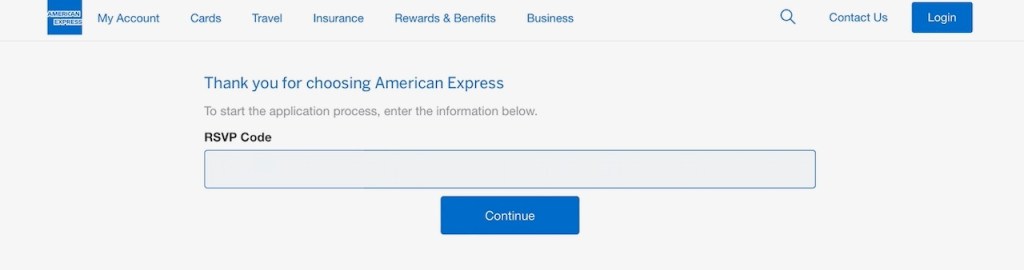

I applied on the offer through Perkopolis. This generated a unique code, which was then to be entered on the American Express Canada website to validate the additional welcome bonus.

I followed the links through and was taken over to the American Express application website. The Perkopolis offer was accurately replicated on the American Express website without any functionality challenges.

I was requested to enter the Perkopolis code on a secondary screen to validate the offer. The offer validated without any obvious issues, with the code being accepted.

The website offered terms and conditions of the American Express Cobalt 5X eats and drinks earning offer, 3X on eligible streaming services and 2X at stand alone gas stations, local commuter transportation in Canada including street car, subway and taxi. limousine and ride sharing. It’s clear that the terms and conditions would require a little study on the card holder’s part if you were looking to maximize the benefits.

Processing the Application:

I have been an existing American Express cardholder for twenty four years. I currently hold the American Express Platinum Business Charge Card, the American Express Marriott Bonvoy Credit Card and the American Express Bonvoy Business Credit Card. As such, I’ve been fortunate enough to establish a long financial relationship with American Express.

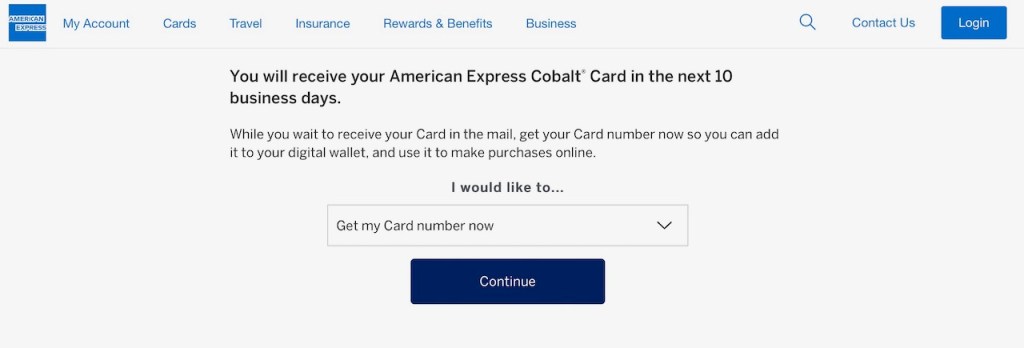

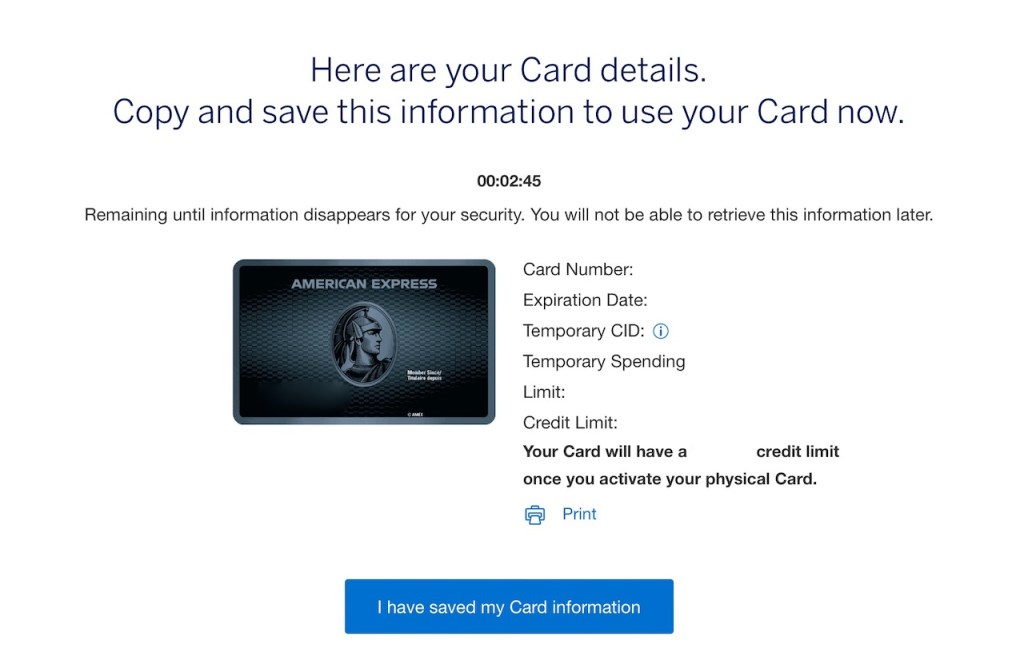

With a long existing history with American Express Canada, my card approval came instantly. I was promised delivery of the American Express Cobalt Card within 10 business days.

I was given an option to import the card information into Apple Pay. I was able to complete this step, and got my card uploaded into Apple Pay for immediate use without any technical challenges.

Using the American Express Cobalt Card:

My card arrived as promised in approximately six business days. The card was easy to activate on the American Express Canada website.

I started using the card immediately. After some use, and after my transactions posted, I was able to do a little research to maximize earning opportunities.

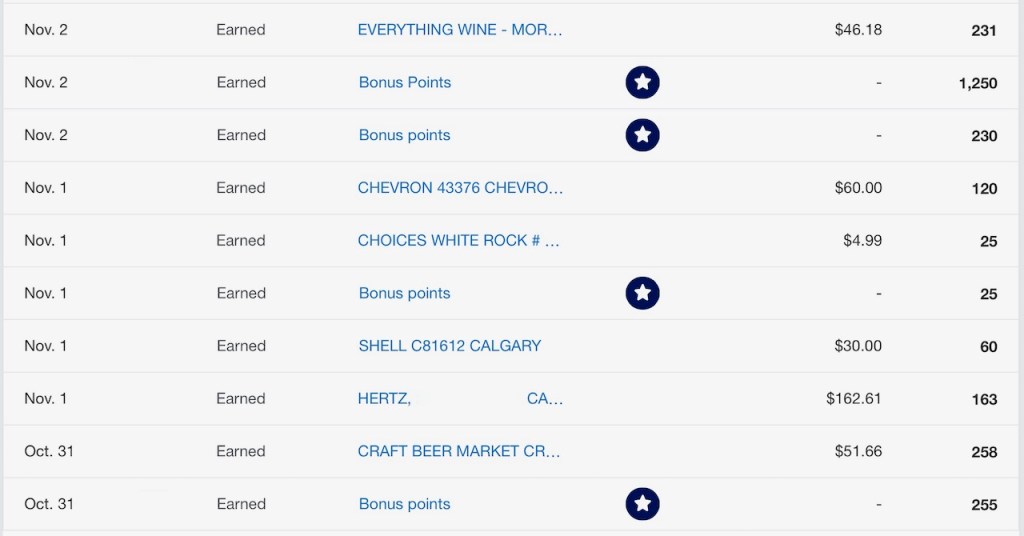

By signing into the American Express Membership Rewards portion of the website, I was able to track my spending.

I was able to determine the amount of room left in the additional 10,000 Membership Rewards points on eats and drinks within the first three months. I was also able to confirm that after meeting the minimum spend of $750 was met, that the welcome bonus 1,250 points were added to the account.

Doing a little math, I was able to manage my rewards in order to maximize the welcome bonus. While this wasn’t a “set and forget” welcome bonus, it’s true that with most things related to points and miles, this application required a little oversight in order to get the most out of it.

Merging the American Express Membership Rewards Accounts:

My American Express Cobalt Card started earning Membership Rewards into a separate Membership Rewards account. After several years of earning under the American Express Business Platinum card, I had accumulated a sizeable balance. I contacted the American Express customer service line to see whether it was worthwhile merging these two Membership Rewards accounts.

It was recommended to me by American Express Canada to keep the accounts separate until the end of the welcome bonus period. In my case, that was about one year. As a result, I didn’t end up merging the accounts. While it was a little inconvenient to monitor the balances in two separate accounts, I wasn’t willing to risk the bureaucracy of having to chase membership of a welcome bonus.

In Summary: Completing an American Express Cobalt application

After all this time, I finally joined the clients that hold the American Express Cobalt Card. Already, I am finding a strong earning potential given that I find myself on the road frequently for business travel dining out at restaurants.

The only negative to the application process was having to keep track of two American Express Membership Rewards accounts for the first year. I would also have to spend a little effort tracking the additional bonus of 10,000 Membership Rewards points.

Otherwise, I think this card will make a solid addition to my wallet given it’s generous earning for points in the eats and drinks categories.

World Traveller 73

World Traveller 73

Cobalt used to give 5X for international dining, but it stopped a few months ago (still had to pay Fx). Could have used it for you Vegas meals…

Did you hear about the new Alaska card? You can sign up for waitlist and get 5500 miles on top on regular bonus. Any. upcoming trips?

LikeLike

Surprisingly, I have been using through the USA over the last few weeks. Although the regular eats and drinks category bonus has ended, it seems Amex had yet to update the supplemental category sign up bonus language. As a result, instead of getting the 10x miles on drinks and eats, it seems it’s been possible to earn 6x (1 + 5x sign up promotional miles) on eats and drinks in the USA.

San Antonio, Texas and Maui, Hawaii, USA are coming up !

LikeLike