Changes to American Express Platinum Cardholders (Canada): A Steep Annual Fee Increase with Additional Credits & Benefits

In order to cope with increasing costs associated with delivering an internationally recognized premium card, American Express has hit their Canadian Platinum Charge Card holders with a steep annual fee increase. They have off set this increase with a modest series of credits that will require some work and study in order to get your value out of them. Dependent on your perspective, the changes range from fair to outright bad. Let’s take a look at the differences between the two American Express Platinum personal and business charge cards, and their changes.

Changes to American Express Platinum Cardholders (Canada): A Steep Annual Fee Increase with Additional Credits & Benefits

With word on the internet spreading like summer’s wildfires and through unmarked envelopes received in the Canada Post mail this week, Canadian American Express Platinum Card holders were recently notified of a steep annual fee increase. These changes can range from really bad to moderately acceptable, depending on your perspective.

The changes are different dependent on which version of the card you hold as there are two different value propositions for the personal Platinum Card and the Business Platinum Card.

The American Express Platinum Cards offer a whole suite of benefits. While I won’t go over each benefit within this post, I encourage you to visit my post of the American Express Platinum Card (Review) to understand the inclusions and benefits currently offered on this suite of cards.

It’s worth specifically pointing out that these changes apply only to American Express Platinum Charge Cards that are issued in Canada.

American Express Platinum Card Changes (Personal card):

These changes take effect on September 26, 2023, unless otherwise specified. Again, this applies to the Canadian version of the American Express Platinum Charge Card.

Annual Fee increase from $699 to $799

The Annual Fee on the American Express Platinum Card is set to increase from $699 to $799 CAD.

This is a relatively minor $100 price increase that can easily be offset by the new additional credits.

Supplemental Card Fees increase from $175 to $250

The cost for carrying a supplemental American Express Platinum Card is set to increase from $175 to $250.

A supplemental Platinum Card includes American Express Centurion Lounge Access and a Priority Pass Select membership and their lounge guesting privileges, without the primary cardholder having to be present.

A $200 Annual Dining Credit is being added.

To offset these annual fee increases, American Express is adding an annual $200 Annual Dining Credit. This credit is valid on the American Express Platinum personal version of the card only.

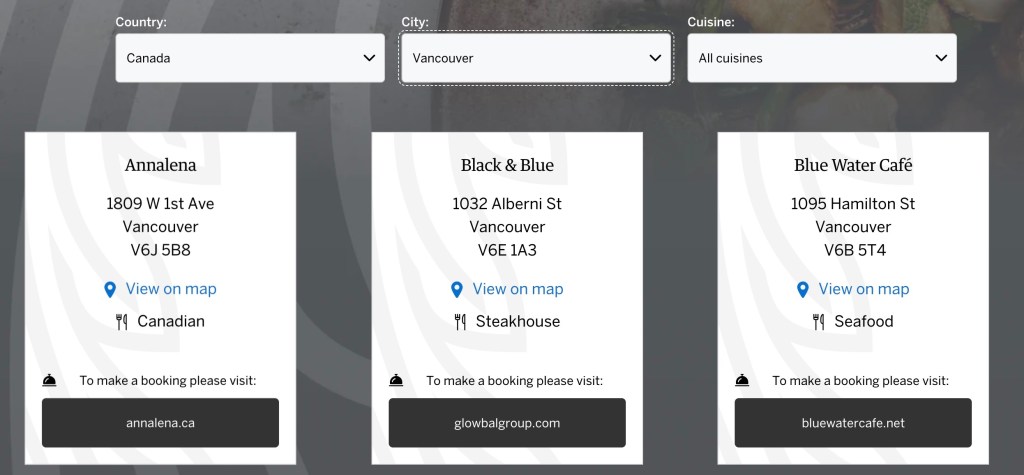

The Annual Dining Credit requires dining at specific restaurants. The restaurants in my home city of Vancouver, Canada are located in hip, upscale locations. The dining credit requires registration through the Amex Offers portion of the American Express website or American Express App.

The Canadian version of the restaurant portal directory is not working, but you may be able to see eligible restaurants by visiting the Singapore version of the American Express Dining Directory, which offers a global restaurant directory for their version of the Platinum card that features the Annual Dining Credit. You will have to change the country to Canada (or the United States) in order to see the restaurants near you.

The Annual Dining Credit can be applied at globally qualifying restaurants. While you don’t have to be in Canada in order to redeem the credit, I was a little surprised to see how few restaurants are actually accessible for this offer.

There are only 109 restaurants available in the entire country of Canada. In New York, USA, where there are over 1,000 different restaurants within the city, there are only 30 that are available for Annual Dining Credit redemption.

Clearly, your location and enjoyment of specific restaurants will determine how much value you get out of this particular feature. If you happen to be in Edmonton, Canada the two restaurants listed in the directory aren’t likely to make this feature particularly valuable unless you visit them on a regular basis. You’ll have to be selective and careful in order to fully take advantage of this benefit.

Membership Rewards Earn Rate to Decrease from 3x to 2x on Restaurants.

The American Express Platinum personal card is decreasing on the earn rate for the restaurant category. The rate is reducing from 3x Membership Rewards per dollar to 2x Membership Rewards per Dollar, as of October 26, 2023.

American Express Platinum Charge Card holders will continue to earn 1x Membership Rewards point per Dollar on all other categories of purchases.

For those that earned a substantial amount of points under this category of spend, this represents a major cut in Membership Rewards earnings.

American Express Business Platinum Card Changes (Business card):

These changes take effect on September 26, 2023, unless otherwise specified. Again, this applies to the Canadian version of the American Express Business Platinum Charge Card.

This happens to be the card that I hold, so I’m most actuely impacted under this particular category.

Annual Fee increase from $499 to $799

The Annual Fee on the American Express Platinum Card is set to increase from $499 to $799 CAD. This is effective as of September 26, 2023.

All I can say to this is: “Ouch!”. This is a substantial $300 a year annual fee increase, although it does increase the overall dollar amount that can potentially be written off on your income taxes as a deductible business expense under Canada Revenue Agency at year end.

I would imagine businesses will have no concern writing this off as the cost of doing business. However, a steep annual fee increase always impacts sole proprietorships or limited partnerships like mine.

Supplemental Card Fees increase from $199 to $250

The cost for carrying a supplemental American Express Platinum Card is set to increase from $175 to $250. This is effective as of September 26, 2023

In my household, we have one additional business Platinum card. The fee to carry this extra card will be going up by $51.

A supplemental Platinum Card includes American Express Centurion Lounge Access and a Priority Pass Select membership and their lounge guesting privileges, without the primary cardholder having to be present.

A $200 Annual Travel Credit is being added.

To offset these annual fee increases, American Express is adding an annual $200 Annual Travel Credit. This feature is also currently found on the American Express Platinum Card personal edition. This is effective as of September 26, 2023.

The Annual Travel Credit requires a purchase of two hundred dollars or more through the American Express Travel on line travel agents on airfare, hotel, or a car rental. This includes reservations made under American Express Fine Hotels and Resorts program.

While I find it pretty inconvenient to book travel through the American Express travel portal, I can’t imagine that it will be too hard to get value out of this addition at least once per year.

A $100 Canadian Nexus Application Fee Credit is being added.

The American Express Business Platinum charge card will add a $100 credit for applying for a Nexus Trusted Traveller Membership. This credit is valid once every 4 years. This is effective as of September 26, 2023.

This represents a pro-rated value of about $25 per year; spread over four years between renewals.

This feature is also offered on the Toronto Dominion TD Visa Aeroplan card. This is another card I happen to hold. As a result, I don’t get a lot of value from this feature by holding both credit cards. I would have to get creative and renew my wife’s membership with one card, and my membership with another.

A $120 Canadian Wireless Credit is being added

The American Express Business Platinum charge card will add a $120 credit for payment of Canadian wireless cellular invoices. This credit is applied on a monthly basis of $10 credit per month. This is effective as of October 1, 2023.

Enrolment is required through the Amex Offers tab, on a one time basis.

This will be fairly easy to redeem, providing a change my current cellular billing from the American Express Marriott Bonvoy card. This was a hold over from when I was charging everything to the American Express Starwood Preferred Guest credit card when it was the best credit card in the game.

A $200 Dell Computer Credit is being added

The American Express Business Platinum charge card will add a $200 credit for purchases at Dell Canada. The credit is applied in $100 increments every six months. This is effective as of July 5, 2023

Enrolment is required through the Amex Offers tab, on a one time basis.

American Express has gotten smart on this offer. If you purchase a laptop computer, you’ll only get $100 as a credit. This credit can possibly be used up for accessories or other electronics needed around the house or office, along as you purchase them in six month apart intervals across the periods of the calendar year.

A $300 Indeed Credit is being added:

The American Express Business Platinum charge card will add a $300 credit for use of Indeed advertising space for employers.

This is effective as of July 5, 2023

Enrolment is required through the Amex Offers tab, on a one time basis.

As a limited partnership, I really have limited to no use for this credit, so it doesn’t add a lot of value in my circumstances.

Mobile Device Insurance is being added:

The American Express Business Platinum charge card will add complimentary Mobile Device Insurance to the card. This is effective as of September 26, 2023.

This is a great benefit to have, although per the terms and conditions, it will take card holders some time before they see the value in this. In order for coverage to be valid, it requires the device to be fully charged to the card; something that existing card members won’t likely see until they actually replace their smart phone mobile devices and charge it to the American Express Business Platinum card at some point in the future.

This isn’t a feature I have with any other card so there is some value to be had by adding this feature. Unfortunately, most won’t see the value in this until they actually replace their phones, which can occur every one to three years in the future; depending on how quickly you replace your smartphone devices.

No Change to Platinum Business Membership Rewards Earn Rate:

American Express Business Platinum Charge Card holders will continue to earn 1.25x Membership Rewards point per Dollar on all categories of purchases.

This is about the only good news about this particular revision. American Express Canada is allowing a similar earn rate which is pretty good, but overall consistent with other premium cards in the Canadian marketplace.

My Thoughts on the Changes:

Wow – the changes announced to the American Express Platinum personal and business cards in Canada are substantial. The changes are likely to impact many people’s interest in maintaining this particular card. The high annual fee tends to put a lot of people off over time, and I would imagine that these changes will have a number of American Express card holders calling to cancel their card membership with American Express Platinum.

For the personal card, the card now likely represents the better value of the two. Most people won’t be put off by a one hundred dollar annual fee increase that now comes with a two hundred dollar dining credit. In addition to the travel credit that currently exists on the card, the annual fee represents the best amount of inclusions for spend.

For the business card, the card has gotten substantially more expensive. While the generous earn rate of 1.25 Membership Rewards points per dollar hasn’t changed (and remains class leading within Canada), the additions of the two hundred dollar travel credit and one hundred and twenty dollar cellular credit offset some of the cost. The addition of the two hundred dollar Dell and Indeed credits do not really move the needle for me. I am doubtful to use these credits; especially as Apple users. The only possible advantage to the business card is that the annual fee represents a larger amount that can be written off against your business with Canada Revenue Agency.

The big point that American Express Canada doesn’t seem to recognize with these increases is that acceptance of the American Express card remains painfully bad within Canada. Many merchants refuse to take this card due to the exceptionally high merchant fees. Unlike in the United States, I frequently have difficulty getting this card to be accepted outside of urban Vancouver. I wish American Express would work on getting more merchants to accept the card in the first place, as this would make the card’s overall value proposition to be much stronger than it is today. They could then get away with higher annual fees, a lot more easily.

In Summary: American Express Increases Annual Fee & adds some questionable credits of select use.

American Express Canada has revised it’s Platinum Card benefits for its personal and business versions of their Platinum cards.

Dependent on whether you hold the personal or business versions of the card, you’ll be seeing an annual fee increase of between $100 to $300 in exchange for several hundred dollars of benefits yu’ll have to pay attention to in order to maximize your value from this card.

I think these annual fee increases will likely cause me to possibly switch from the business version of this card to the personal one, as the added benefits of the personal card seem to align more with my current interests (including those of my business).

Ultimately, I wish American Express cards in Canada would have greater market acceptance. This would allow card holders to get even more value out of these cards than they currently do.

If you’re looking to Sign Up for the American Express Platinum Card, please feel free to use the attached referral link for the highest possible sign up bonus. As always, I thank you for your support.

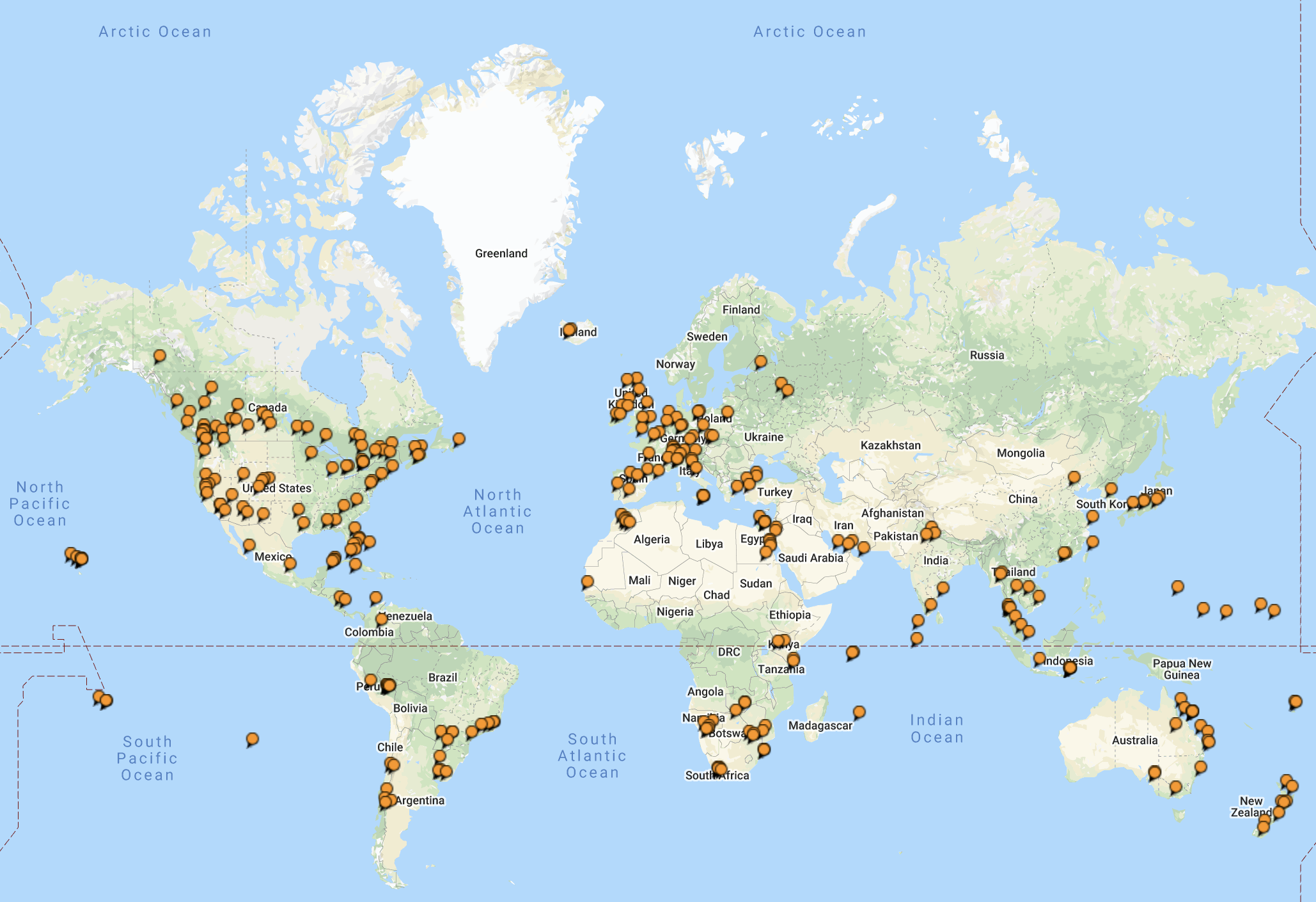

World Traveller 73

World Traveller 73

We switched out our Corp Platinum for a personal one a few cycles ago. Still use it for business expenses so not sure what Amex is thinking with this Corp card jump.

a Q- the working in the Annual Dining Credit references ‘participating local restaurants’. I interpreted this to be ‘local to me/in Canada’. Do you know if it is truly globally applicable or do we need to wait for Sept 26 when the offer becomes activated?

LikeLike

I didn’t get the terms and conditions with the personal card (having only the business version).

The travel credit is marketed as follows:

Starting September 26th , you will have access to a $200 CAD Annual Travel Credit for use on air, hotel, car rental or vacation bundles booked through American Express Travel – to be issued on your next anniversary on or after September 26, 2023.

I read this as the credit becomes available after your anniversary with the new fee.

I believe this to be a global dining benefit , although I guess we will have to wait and see for the websites to be fully updated.

My renewal fee happened to hit in August, so it will be over a year before I’m likely to see many of the enhanced features.

LikeLike

My Bus Platinum with an anniversary in late August was just billed the $799 (on Sept 27, 2023). I called Card Services in mid-Aug 2023 to confirm the fee will be $499 for another year, and they confirmed this was correct because my anniversary date was before Sept 26. After I was billed $799 I called again and the Card Services person thought it was a mistake and from what they knew it should have been $499, but the higher ups said $799 was correct. They are escalating and will get back to me. I think either their programming/billing team and their marketing team were given conflicting information resulting in this mistake which is probably effecting any existing card holders who are billed on or after the 26th of the month.

LikeLike

Yikes; hopefully they’ll give you some goodwill for the renewal close to the expiration date.

It’s hard to manage such a large change in annual fee structure but I’m not super empathetic to American Express, given it’s lower than helpful acceptance rate within Canada.

LikeLike

Just following up on my Bus Platinum card that was billed $799 on Sept 27 in case anyone is interested in what happened. After a few discussions with a manager at Amex over a week or so, they credited me back $300 as a fee error and told me that there were many people in my situation that would be getting the same correction. So, I don’t get the $200 travel credit this year, but otherwise I should get all of the other benefits this year for the old $499 fee. Next year I’ll be sure to use the travel credits to try to make up some of the fee increase.

LikeLike

It seems that after reading the fine print, many of the credits roll out over the course of the year.

Having been billed in august, my travel credit won’t be available until next annual cycle.

The device insurance only really applies after you purchase a new cellular device and charge it to the card.

However, I registered for my wireless billing credit and I’ve already received my first $10 credit on my September bill.

Thanks for reporting back “thereasonableblogger”

LikeLike

In my view, the 60% increase in the Business Platinum fee is simply not worth it! Again, if American Express was accepted at more locations, perhaps I would not abandon it!

LikeLiked by 1 person

It’s an interesting move for Canadian Credit Card Holders in a country that doesn’t have a single Centurion Lounge and lessened amount of disposable income. I can only guess that this is needed in order to keep the bills paid on American Express’ side.

LikeLike